Pulse of Information

Your source for the latest insights and updates.

Whole Life Insurance: The Hidden Gem of Financial Security

Discover why whole life insurance is the ultimate secret to financial security and why it’s time to invest in your future today!

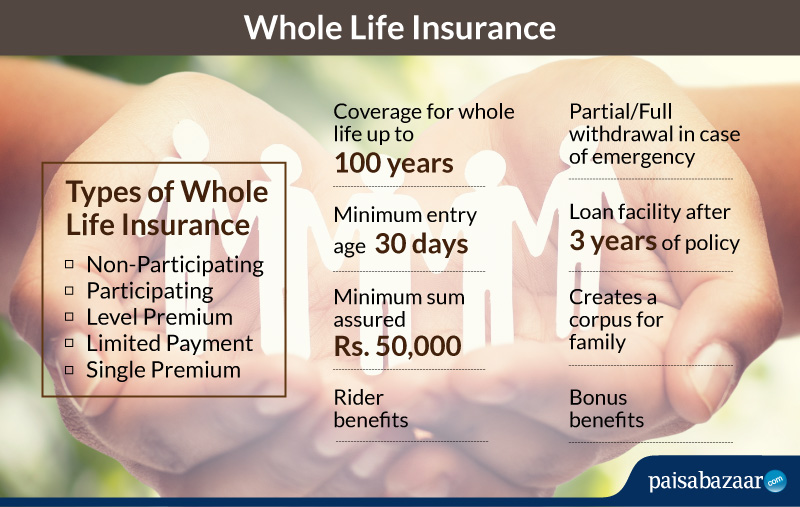

Understanding Whole Life Insurance: Benefits and Features Explained

Whole life insurance is a type of permanent life insurance that provides lifelong coverage, ensuring that your beneficiaries receive a death benefit upon your passing. One of its key features is cash value accumulation, which grows over time on a tax-deferred basis. This means that as you pay your premiums, a portion goes into a savings component that can be accessed during your lifetime through loans or withdrawals. Additionally, whole life policies typically offer guaranteed premiums, which means your premium payments remain constant throughout the life of the policy, providing financial stability and predictability.

The benefits of whole life insurance extend beyond just providing financial security to your loved ones. For instance, it offers a guaranteed death benefit that can help cover final expenses, pay off debts, or leave a legacy. Furthermore, the cash value component acts as a financial safety net, allowing policyholders to borrow against it in times of need. Another noteworthy aspect is the potential for dividends, as many whole life policies are eligible to receive dividends, which can be reinvested to increase the policy's cash value or used to reduce premium payments. Overall, understanding these benefits and features makes whole life insurance a valuable option for those seeking long-term financial security.

Is Whole Life Insurance Right for You? Essential Questions to Consider

Deciding whether whole life insurance is the right choice for you requires careful consideration of your financial goals and personal circumstances. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong protection and builds cash value over time. To help you assess if this type of policy aligns with your needs, ask yourself the following questions:

- What are my long-term financial goals?

- Am I looking for a policy that can provide both insurance coverage and an investment component?

- How comfortable am I with the higher premium costs associated with whole life insurance?

Another critical aspect to evaluate is your current financial situation and insurance needs. Whole life insurance can be an excellent option for individuals seeking stability in their financial planning, but it may not be suitable for everyone. Consider the following factors:

- Your age and health status

- Your dependents and their financial needs

- Your other financial obligations and investments

By reflecting on these essential questions, you can determine if whole life insurance is a smart financial choice for your future.

The Long-Term Value of Whole Life Insurance: A Comprehensive Overview

The long-term value of whole life insurance lies in its unique features that provide both financial security and a reliable savings component. Unlike term life insurance, which only offers coverage for a specific period, whole life insurance ensures coverage for the lifetime of the insured. This type of policy not only pays a death benefit to beneficiaries but also accumulates cash value over time. As premiums are paid, a portion goes into a savings account that grows at a guaranteed rate, creating a financial resource that policyholders can tap into during their lifetimes.

Investing in whole life insurance offers numerous advantages that can significantly enhance financial planning. Policyholders can borrow against the accumulated cash value, providing liquidity in times of need without sacrificing their coverage. Additionally, the cash value grows tax-deferred, making whole life insurance an attractive option for individuals looking to diversify their financial portfolio. In summary, the long-term value of whole life insurance is not just in the death benefit it provides, but also in the stability and financial options it offers throughout a policyholder's lifetime.