Pulse of Information

Stay updated with the latest news and insights.

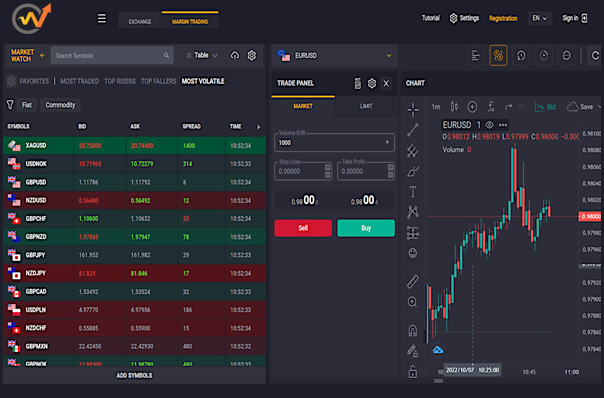

Currency Caper: How to Profit from the Forex Heist

Uncover the secrets of the Forex Heist and discover how to turn currency trading into profits. Don't miss your chance to cash in!

Understanding Forex: The Art of Currency Trading

Understanding Forex: The art of currency trading offers a dynamic landscape for investors looking to capitalize on the fluctuations in the foreign exchange market. Unlike traditional stock trading, Forex involves the buying and selling of currencies, aiming to profit from changes in exchange rates. As a decentralized market with high liquidity, it operates 24 hours a day, making it accessible for traders around the globe. To navigate this complex environment, it is essential to grasp key concepts such as pips, leverage, and margin, which play an integral role in determining potential profits and risks.

Successful Forex trading requires a blend of analytical skills and strategic planning. Traders often use various techniques, including technical analysis, which involves studying price charts, and fundamental analysis, which examines economic indicators that impact currency values. Additionally, understanding market sentiment can provide insights into potential price movements. To enhance your skills, consider developing a comprehensive trading plan that includes defined risk management strategies and regularly reviewing your performance to adapt to the ever-changing market conditions.

10 Common Mistakes to Avoid in Forex Trading

Forex trading can be a lucrative venture, but many traders fall into traps that hinder their success. One of the common mistakes is not having a solid trading plan. Without a clear strategy, traders may make impulsive decisions based on emotions rather than market analysis. Additionally, overlooking the importance of risk management can lead to catastrophic losses. It's vital to set stop-loss orders and determine the amount of capital to risk on each trade to shield yourself from unpredictable market movements.

Another prevalent error is the failure to educate oneself about the market. Many novice traders dive headfirst into Forex trading without understanding essential concepts such as currency pairs, leverage, and market analysis. This lack of knowledge can result in misguided trades and missed opportunities. Furthermore, ignoring the significance of keeping a trading journal can inhibit growth; it helps traders to track their performance, analyze mistakes, and refine their strategies over time.

How to Build a Winning Forex Trading Strategy

Building a winning Forex trading strategy requires a structured approach that combines thorough research and practical application. Start by defining your trading goals, such as your risk tolerance and time commitment. Next, conduct an analysis of different trading styles, including day trading, swing trading, and scalping, to determine which suits your personality and lifestyle best. Once you’ve identified your trading style, it’s essential to create a detailed trading plan outlining your entry and exit points, stop-loss levels, and position sizes. This plan will serve as a roadmap, ensuring that you remain disciplined and focused.

In addition to a well-structured plan, developing a robust Forex trading strategy requires continuous analysis and adjustment. Utilize various analytical tools and techniques, such as fundamental analysis and technical analysis, to evaluate market trends and make informed decisions. A great way to test your strategy is by using a demo account, which allows you to practice without risking real capital. Furthermore, keep a trading journal to document your trades, emotions, and outcomes. This will help you to reflect on your performance, identify areas for improvement, and ultimately enhance your strategy for greater success in the Forex market.