Pulse of Information

Your source for the latest insights and updates.

Disability Insurance: Your Safety Net or Just Another Bill?

Is disability insurance a financial safety net or just another expense? Discover the truth and make informed choices for your future!

Understanding Disability Insurance: A Comprehensive Guide

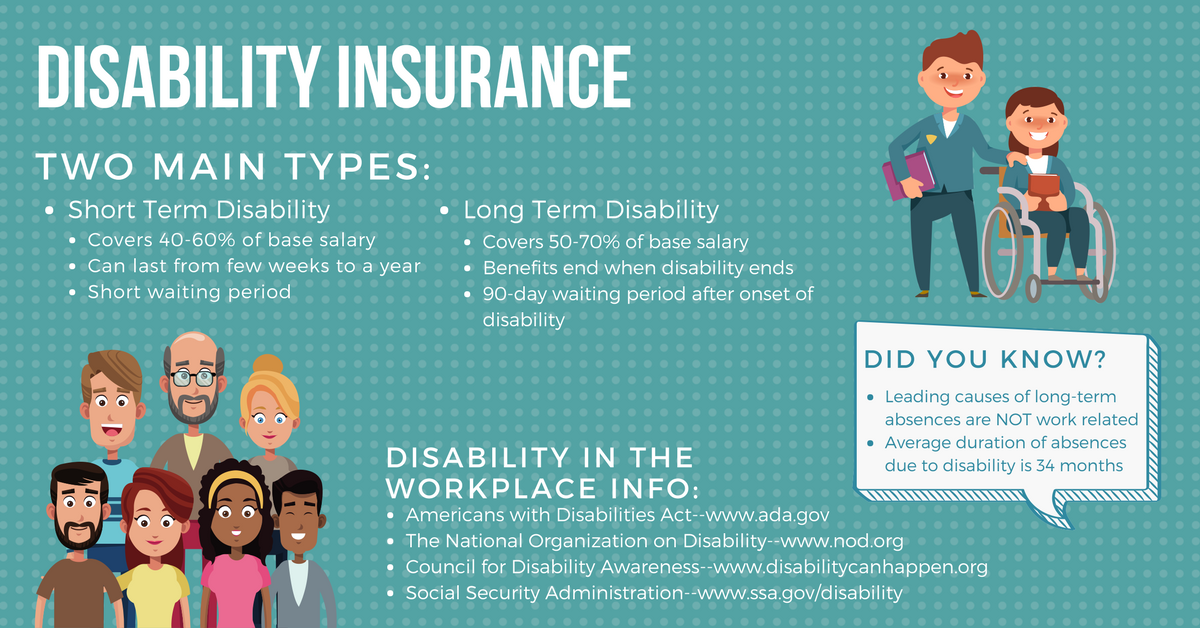

Understanding Disability Insurance is crucial for anyone looking to protect their income against unforeseen health issues that can impede work ability. This type of insurance offers financial support by replacing a portion of your income if you become unable to work due to a disability. There are two primary types of disability insurance: short-term and long-term. Short-term policies typically cover disabilities lasting a few weeks to months, while long-term policies provide coverage for several months to years, or even until retirement age. Knowing these details can help you choose the right policy that meets your specific needs.

When evaluating plans, it’s essential to consider factors such as monthly benefits, elimination periods, and coverage options. The monthly benefit is the amount you’ll receive if you become disabled, and it usually ranges from 40% to 70% of your pre-disability income. The elimination period is the duration you must wait before benefits kick in, which can vary between policies. Additionally, look for coverage options that best suit your occupation, as some plans provide tailored benefits for specific professions. Educating yourself on these aspects will empower you to make informed decisions about your disability insurance.

Is Disability Insurance Worth It? Breaking Down the Costs and Benefits

When considering whether disability insurance is worth it, it's essential to analyze both the costs and benefits associated with this type of coverage. The primary purpose of disability insurance is to provide financial protection in the event that you become unable to work due to illness or injury. While premiums can vary significantly based on age, occupation, and coverage amount, many people find that the peace of mind it offers outweighs the costs. For instance, individual plans can range from a few hundred to several thousand dollars annually, depending on factors such as your income and occupational risks.

On the benefits side, having disability insurance can be a financial lifesaver. In fact, approximately 1 in 4 individuals will experience a disability during their working years, making this coverage critical for maintaining financial stability. In the event of a claim, disability insurance can replace a portion of your salary, helping to cover essential expenses such as housing, healthcare, and daily living costs. When weighing the pros and cons, it's important to consider your personal situation: If you rely heavily on your income to support yourself and your family, investing in disability insurance may well be worth every penny.

How to Choose the Right Disability Insurance Policy for Your Needs

Choosing the right disability insurance policy is crucial for safeguarding your financial future in the event of an unexpected illness or injury. Start by assessing your individual needs, including your current income, savings, and the expenses you would need to cover if you were unable to work. Consider factors such as the length of the benefit period, which is the duration you will receive payments, and the waiting period, which is the time you must wait after a disability occurs before benefits kick in. A thorough evaluation of these elements will help you identify a policy that aligns with your financial obligations and lifestyle.

When selecting a disability insurance policy, it's also important to compare options from different providers. Look for policies that offer comprehensive coverage, including both short-term and long-term disability benefits. Additionally, pay attention to the definitions of disability in each policy, as these can vary widely. Policies that offer 'true own-occupation' coverage provide benefits if you cannot perform your specific job, while 'any occupation' coverage may require you to qualify for benefits based on your ability to work in any job. By understanding these nuances, you can make a more informed decision that truly protects your financial well-being.