Pulse of Information

Your source for the latest insights and updates.

Insurance Policies: The Fine Print You Need to Read Before Signing

Unlock the hidden secrets in insurance policies! Discover the fine print you must read before signing to protect your future.

Understanding Key Exclusions in Your Insurance Policy

When purchasing an insurance policy, it is crucial to understand key exclusions that may not be immediately obvious. Exclusions are specific conditions or circumstances that are not covered by your policy, meaning that if a claim arises under such conditions, your insurer will not be liable to pay. Common exclusions include acts of God, pre-existing conditions, and business-related activities for personal insurance policies. By carefully reviewing your policy documents and seeking clarity from your insurer, you can ensure that you are adequately informed about what is or isn’t covered. For more information on understanding your insurance policy, you can visit National Association of Insurance Commissioners.

Being aware of exclusions can help you avoid unpleasant surprises during the claims process. To effectively navigate your insurance coverage, consider the following steps:

- Review the policy: Take the time to read through your policy documentation thoroughly.

- Ask questions: Don't hesitate to contact your insurance agent if you have any doubts about exclusions.

- Compare policies: Look at different policies to find one that suits your needs and minimizes exclusions.

Top 5 Terms You Must Know Before Signing an Insurance Contract

Before diving into an insurance contract, it's crucial to understand key terms that can significantly impact your coverage and premiums. Here are five essential terms you must know:

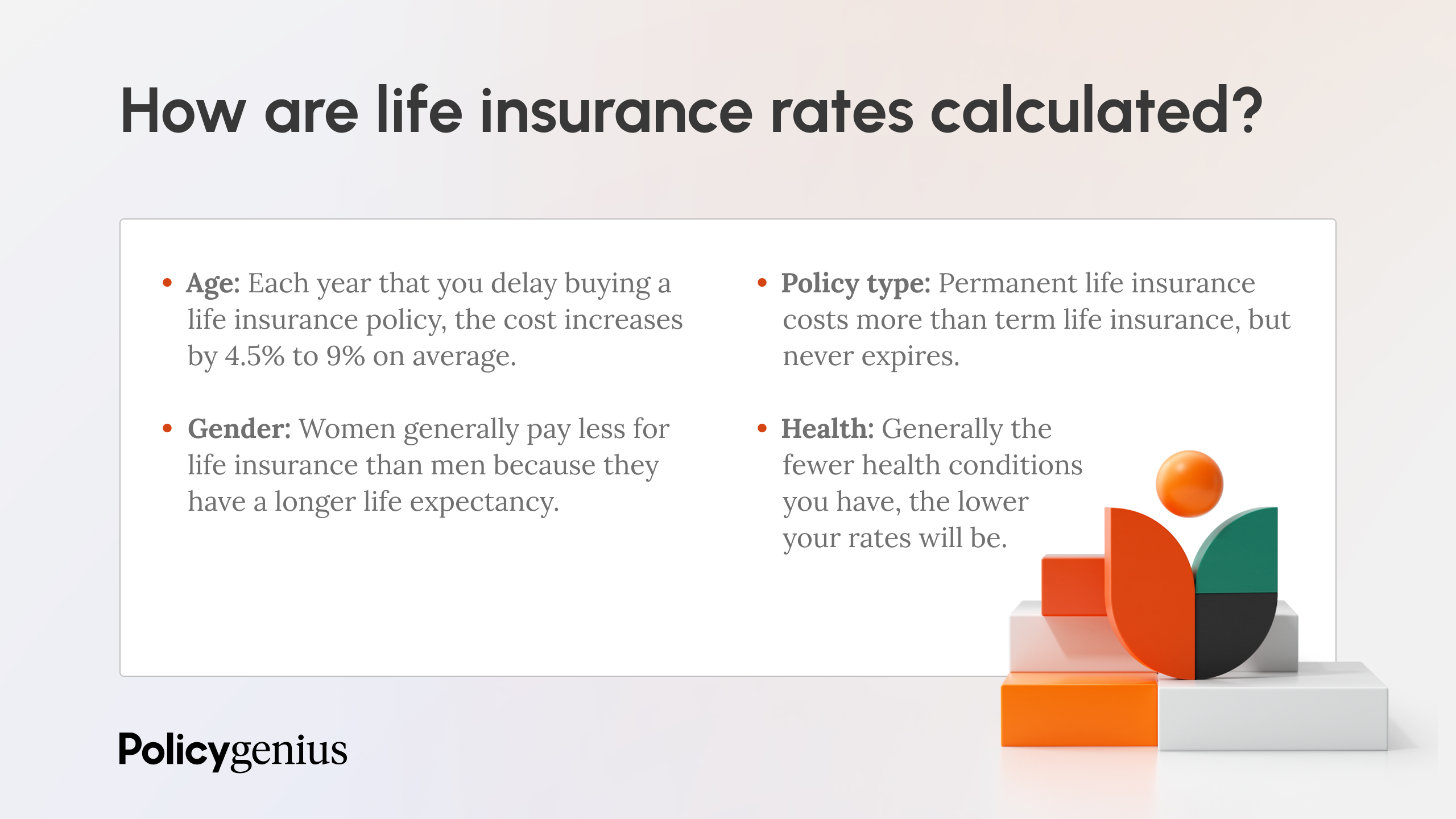

- Premium: This is the amount you pay for your insurance policy, usually on a monthly or annual basis. Knowing how your premium is calculated can help you budget effectively. For more information, visit Investopedia.

- Deductible: This is the amount you are required to pay out of pocket before your insurance kicks in. Understanding your deductible can help you evaluate your coverage options and ensure you choose a plan that fits your financial situation. Check out NerdWallet for further details.

Continuing with our essential terms, two more critical ones are:

- Coverage Limit: This defines the maximum amount your insurer will pay for claims under your policy. Familiarizing yourself with your coverage limits is vital to avoid out-of-pocket expenses during a claim. Learn more at Policygenius.

- Exclusions: These are specific conditions or circumstances that are not covered by your insurance policy. Being aware of exclusions can prevent surprises when you need to file a claim. For a comprehensive breakdown, head to The Balance.

What Questions Should You Ask Before Finalizing Your Insurance Policy?

Before finalizing your insurance policy, it's crucial to ask the right questions to ensure you're making the best decision. Start by inquiring about the coverage limits and deductibles within the policy. These factors can significantly impact your out-of-pocket expenses during a claim. Additionally, ask about what specific events or damages are covered, as some policies may have exclusions that you need to be aware of. For a comprehensive guide on understanding insurance policies, check out this resource from Nolo.

Another essential set of questions revolves around the claims process. You should ask how easy it is to file a claim and what the claims settlement process looks like. Inquire about the average time frame for claims processing and whether there is a dedicated claims representative available to assist you. It's also wise to find out about customer service options, including support hours and communication channels. This information can be vital for ensuring a smooth experience should you need to utilize your policy. For more insights on evaluating insurance companies, visit this NerdWallet article.