Pulse of Information

Your source for the latest insights and updates.

Insurance Quotes That Could Save You A Fortune

Discover surprising insurance quotes that could save you a fortune! Don’t miss out on the best deals for your peace of mind. Read more now!

Top 5 Tips for Finding the Best Insurance Quotes

Finding the best insurance quotes can be a daunting task, but with the right approach, you can simplify the process. Here are Top 5 Tips for Finding the Best Insurance Quotes to help you save time and money. First, start by gathering information about your coverage needs. Understanding what type of insurance you require—be it for auto, home, or health—will help you narrow down your options. Once you know what you're looking for, consider using comparison tools that allow you to view multiple quotes at once, making it easier to find the best deal.

Next, don't underestimate the power of shopping around. While you may have a preferred insurance company, it's essential to explore other options as well. Different insurers offer varying rates based on your personal circumstances, so it's worth investing the time to get several quotes. Additionally, consider speaking with independent insurance agents who can provide personalized recommendations and help you navigate through the complexities of different policies. Lastly, always read customer reviews and check ratings to ensure that you're choosing a reputable insurer that meets your needs.

How to Compare Insurance Quotes Like a Pro

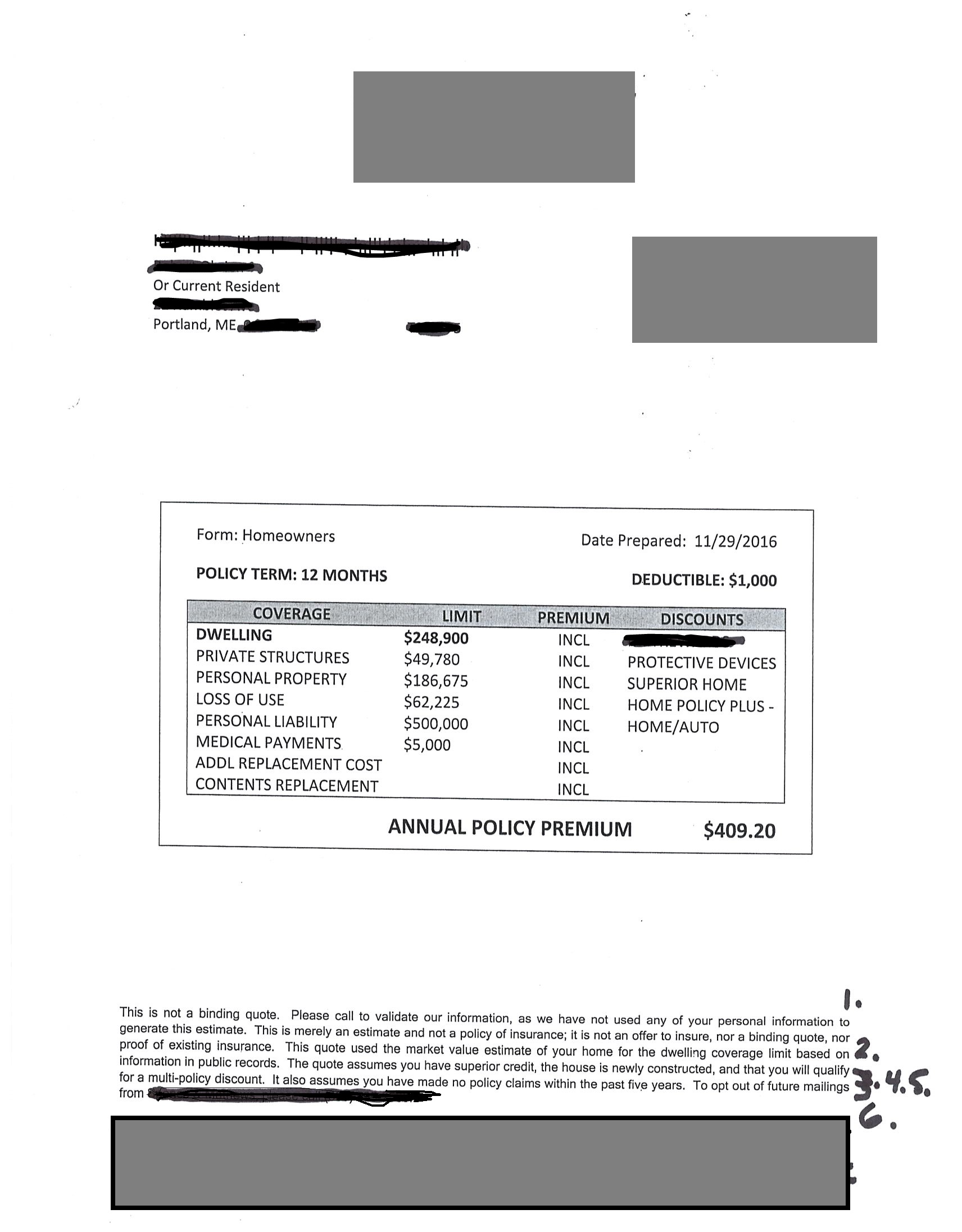

When it comes to comparing insurance quotes, approaching the process systematically can save you time and money. Start by gathering quotes from multiple insurance providers to ensure you're viewing a range of options. Create a comparison chart listing key details such as coverage limits, deductibles, and premiums. This visual representation will help you quickly identify the best value. Additionally, don’t forget to read the fine print, as some policies may have exclusions that could affect your overall satisfaction.

Once you have your quotes organized, evaluate the coverage levels and features offered by each policy. It might be tempting to choose the cheapest option, but it’s crucial to ensure that you’re not sacrificing essential coverage for a lower price. Consider using a grading system—assign points based on your personal criteria to help quantify how each policy meets your needs. By scrutinizing both the prices and the benefits of the insurance quotes, you’ll be better equipped to make an informed decision and protect your assets without breaking the bank.

What Factors Influence Your Insurance Quotes?

When it comes to understanding insurance quotes, several key factors come into play that can significantly influence the premium you are quoted. Firstly, your personal details including age, gender, and marital status can affect your risk profile. For instance, younger drivers often face higher auto insurance quotes due to a perceived higher risk of accidents. Additionally, your credit score can also have a substantial impact; many insurers use it as a factor in determining your quote, with higher scores often resulting in lower premiums.

Moreover, the type of coverage you choose plays a crucial role in shaping your insurance quotes. Variations in deductibles, coverage limits, and the inclusion of additional riders like comprehensive or collision coverage can lead to significant differences in quoted premiums. Furthermore, factors such as your driving history, the type of vehicle you own, and even your location can enhance or diminish the cost of your insurance. Understanding these elements can empower you to make informed decisions and potentially save on your insurance costs over time.