Pulse of Information

Your source for the latest insights and updates.

Insurance Showdown: Who Offers the Best Bang for Your Buck?

Discover which insurance providers deliver the ultimate value! Uncover tips and tricks for the best deals on your coverage.

Top 5 Insurance Providers: Evaluating Value for Money

When it comes to choosing the top insurance providers, evaluating value for money is essential. Several factors come into play, including coverage options, premium rates, and claims satisfaction. In this article, we will explore the top 5 insurance providers and analyze what makes them stand out in terms of affordability and service quality.

1. Provider A: Known for its competitive pricing and extensive coverage options, Provider A consistently ranks high in customer satisfaction surveys.

2. Provider B: Offers a unique combination of low premiums and a high claims approval rate, making it a popular choice among budget-conscious consumers.

3. Provider C: With personalized service and tailored plans, this provider excels in meeting individual needs while maintaining cost-effectiveness.

4. Provider D: A strong player in the market, Provider D is recognized for its transparency in policy terms and claims handling.

5. Provider E: Offers value-added services that enhance the overall customer experience, ensuring that clients feel secure and supported.

What to Look for in an Affordable Insurance Plan?

When searching for an affordable insurance plan, it’s essential to prioritize your needs while balancing cost. Start by evaluating the coverage options available to ensure they align with your personal requirements. Look for plans that cover essential health services, such as hospitalization, preventive care, and prescription medications. Additionally, consider the deductibles and co-payments associated with the plan, as these factors can significantly affect your out-of-pocket expenses.

Another crucial aspect to consider is the network of providers included in the plan. A wider network can offer you more flexibility in choosing healthcare professionals and facilities. It's also advisable to review customer reviews and ratings, as they can provide insights into the insurance company’s reputation and reliability. Lastly, ensure to read the fine print regarding any exclusions or limitations on coverage to avoid unexpected expenses. Overall, taking these steps can help you find an affordable insurance plan that meets your needs without sacrificing quality.

Comparing Costs: Which Insurance Offers the Best Coverage for Your Budget?

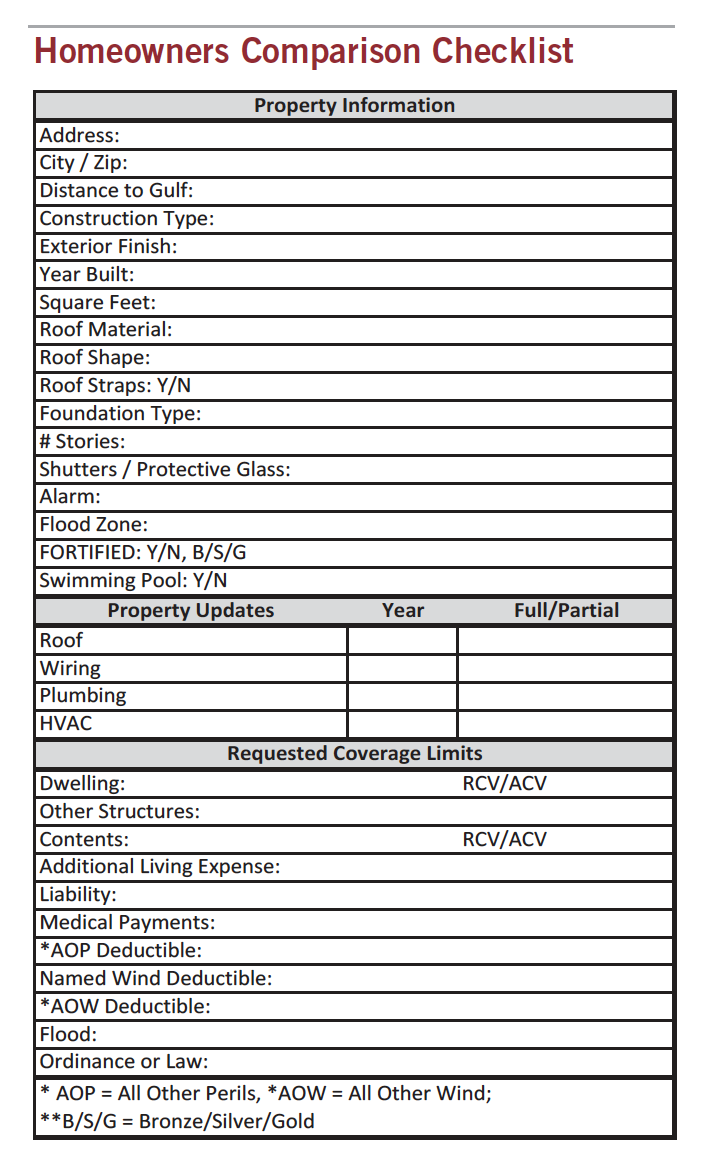

When evaluating various insurance options, it’s crucial to compare costs and assess which insurance offers the best coverage for your budget. Start by collecting quotes from multiple providers, looking not only at the premiums but also at the deductibles, co-pays, and out-of-pocket maximums. Consider using a table to visually organize these factors, making it easier to identify the most cost-effective plans. Additionally, don't forget to factor in any discounts or bundled policies that can further reduce your overall expenses.

Once you have a clear picture of the available options, analyze the coverage details to determine which insurance aligns best with your financial situation. For example, a policy that is cheaper in monthly premiums may come with higher deductibles, meaning you'll pay more out of pocket when you need care. On the other hand, a comprehensive plan with a higher monthly premium might provide substantial benefits when managing unexpected health events. Weighing these factors carefully will help you find the right balance between affordability and adequate protection.