Pulse of Information

Stay updated with the latest news and insights.

Insuring Your Dreams: How to Protect Your Small Business from the Unexpected

Protect your small business from the unexpected! Discover essential tips and tricks to insure your dreams and safeguard your future.

Top 5 Unexpected Risks Small Businesses Face and How to Insure Against Them

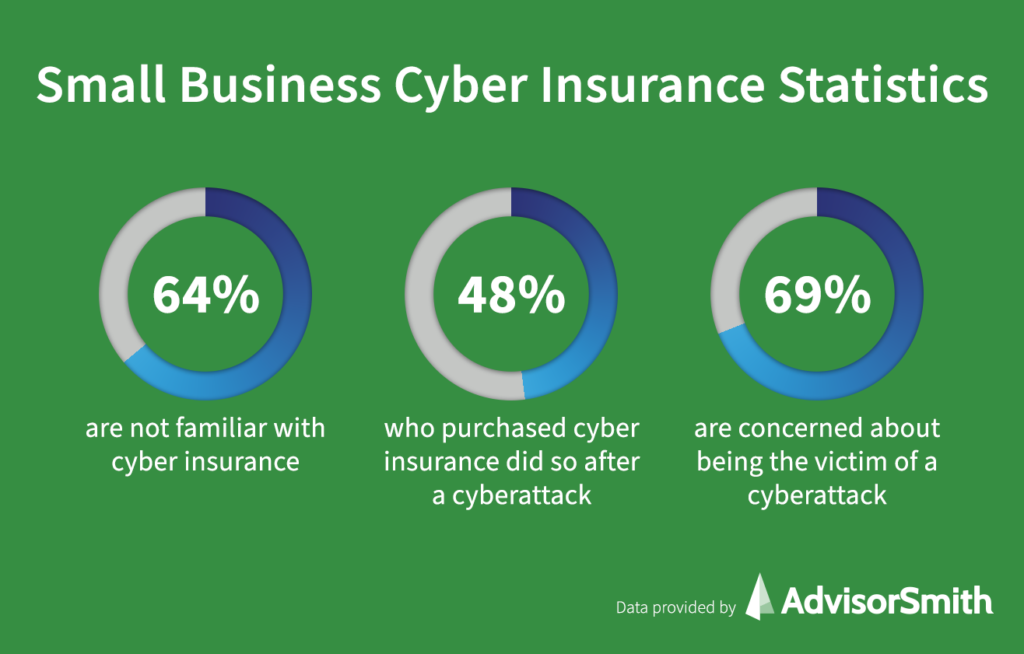

Small businesses often prepare for well-known risks like natural disasters or theft, but there are unexpected risks that can jeopardize their operations. For instance, cybersecurity threats pose a significant risk, even for small companies that might not think they are targets. According to various studies, a majority of small businesses lack the appropriate cybersecurity measures needed to protect sensitive data. Another looming risk is the rise of reputational damage due to social media backlash or online reviews. Poor customer feedback can spread quickly, leading to loss of customer trust and revenue.

To safeguard against these risks, small business owners should consider investing in comprehensive insurance policies designed for modern threats. For example, cyber liability insurance can shield businesses from the financial repercussions of a data breach, while professional liability insurance can protect against claims related to service delivery failures. Additionally, developing a solid crisis management plan can help mitigate potential reputational harm. This strategy involves monitoring online activity and response protocols to crises, which can significantly enhance a business’s resilience to unexpected risks.

Essential Insurance Coverage Every Small Business Should Consider

Having the right insurance coverage is critical for small businesses to protect their assets and ensure longevity. Some of the essential policies to consider include General Liability Insurance, which covers common risks like bodily injury or property damage. Additionally, Property Insurance safeguards your physical assets, including your office space, equipment, and inventory, against unforeseen events such as fire, theft, or natural disasters. These foundational policies provide a safety net that allows businesses to operate confidently.

Another significant type of coverage is Professional Liability Insurance, also known as Errors and Omissions Insurance, which is crucial for service-based businesses. This policy protects against claims of negligence or inadequate work. Furthermore, it's essential to consider Workers' Compensation Insurance, which provides necessary benefits to employees who undergo work-related injuries or illnesses, demonstrating the business's commitment to employee welfare. In the ever-changing business environment, being proactive about insurance coverage not only mitigates risks but also fosters trust and credibility with clients and customers.

How to Create a Comprehensive Business Continuity Plan for Your Small Business

Creating a comprehensive business continuity plan is essential for safeguarding your small business against unforeseen disruptions. Begin by conducting a thorough risk assessment to identify potential vulnerabilities, such as natural disasters, cyberattacks, or supply chain interruptions. Once you understand the risks, develop a detailed strategy that includes essential functions, critical processes, and key personnel. It’s vital to document these elements so that your employees know their roles during a crisis. Additionally, ensure that you have a robust communication plan in place to keep your team and stakeholders informed.

Next, it's important to regularly test and review your business continuity plan to ensure its effectiveness. Schedule regular training sessions and simulations to familiarize your staff with the procedures, making adjustments as necessary based on the outcomes. Consider creating a checklist that outlines key tasks during an emergency, such as securing data backups, reaching out to clients, and relocating operations if needed. By proactively maintaining and updating your plan, you not only enhance your readiness for any event but also build confidence among your employees and clients in your business’s resilience.