Pulse of Information

Your source for the latest insights and updates.

Pets and Premiums: How to Ensure You're Not Overpaying for Coverage

Discover savvy tips to avoid overpaying for pet insurance and secure the best coverage for your furry friends!

Understanding Pet Insurance: Key Factors That Affect Your Premiums

Understanding pet insurance is crucial for any pet owner looking to safeguard their furry companions from unexpected veterinary costs. One of the primary factors that affect your premiums is the age of your pet. Typically, younger pets tend to have lower insurance premiums due to their overall better health and lower risk of developing chronic conditions. However, as pets age, they may become more prone to various health issues, leading to an increase in monthly premiums. Additionally, the breed of your pet plays a significant role; some breeds are predisposed to specific health problems that can drive up insurance costs. Ensuring you understand these factors can help you make informed decisions when selecting a policy.

Another important aspect to consider is the coverage options available under your policy. Many pet insurance providers offer a variety of plans that may cover just accidents, or a more comprehensive plan that includes illnesses, preventive care, and even wellness visits. The more extensive the coverage, the higher the premium is likely to be. It's essential to evaluate your pet's specific health needs and select a plan that provides the right balance of coverage without breaking the bank. Lastly, remember that your dollars spent may also be influenced by your location; veterinary costs can vary widely by region, impacting the overall cost of your pet insurance as well.

5 Common Mistakes Pet Owners Make That Lead to Overpaying for Coverage

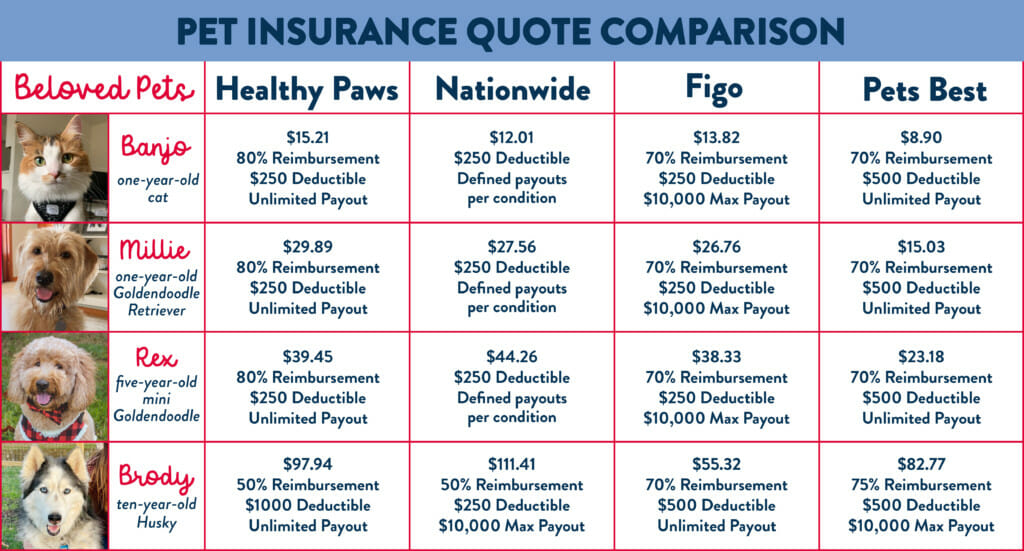

Many pet owners unknowingly make common mistakes that can lead to overpaying for coverage. One significant error is failing to compare policies from different providers. Each insurance company offers varying premiums and coverage options, and not shopping around can result in paying significantly more than necessary. Additionally, some owners overlook understanding the terms and conditions of their policies, such as waiting periods and exclusions, which can also lead to unexpected costs.

Another mistake is choosing a plan based solely on the monthly premium rather than considering the overall value of the coverage. Owners often believe that the cheapest option is the best, but this can backfire if the policy has high deductibles or insufficient coverage for specific needs. Overlooking preventive care benefits is yet another oversight; many policies offer discounts on routine veterinary visits, which can mitigate long-term costs. By avoiding these pitfalls, pet owners can ensure they are not only protecting their furry friends but also saving money on their insurance premiums.

Is Your Pet Insurance Plan Worth It? Questions to Consider Before You Buy

When considering whether pet insurance is worth it, it’s crucial to assess your pet's specific needs and your financial situation. Start by asking yourself how often your pet requires veterinary care. If your furry friend has a history of health issues or if you plan to keep them long-term, investing in pet insurance might save you significant costs in unforeseen medical bills. Additionally, consider the type of coverage offered. Not all plans are created equal, so it’s essential to evaluate what illnesses and conditions are covered.

Another factor to weigh is the cost versus benefits ratio. Create a list of potential expenses for emergencies and routine care to determine if a pet insurance policy aligns with your budget. Ask yourself the following questions:

- What is my pet’s breed and age?

- What are common health issues associated with their breed?

- How much can I comfortably pay out-of-pocket in case of an emergency?