Pulse of Information

Stay updated with the latest news and insights.

Protecting Your Pile: Why Renters Insurance is a No-Brainer

Shield your belongings and save money! Discover why renters insurance is essential for every tenant in our must-read guide.

Understanding the Benefits of Renters Insurance: A Comprehensive Guide

Understanding the benefits of renters insurance is crucial for anyone living in a rental property. Renters insurance is a type of policy that provides financial protection for your personal belongings in case of theft, fire, or other unforeseen events. This coverage often extends to liabilities, meaning if someone is injured in your rented home, the policy can help cover their medical expenses and legal fees. By having renters insurance, you not only protect your possessions but also gain peace of mind knowing that you are financially safeguarded against unexpected incidents.

In addition to protecting personal belongings, renters insurance can offer several additional benefits. For instance, the policy typically covers additional living expenses if your rented unit becomes uninhabitable due to a covered event, allowing you to find temporary accommodation without incurring extra costs. Moreover, renters insurance is often relatively affordable, making it an accessible option for those on a budget. Overall, understanding the benefits of renters insurance can help you make informed decisions and ensure that you are adequately protected in your rental experience.

Renters Insurance 101: What It Covers and Why You Need It

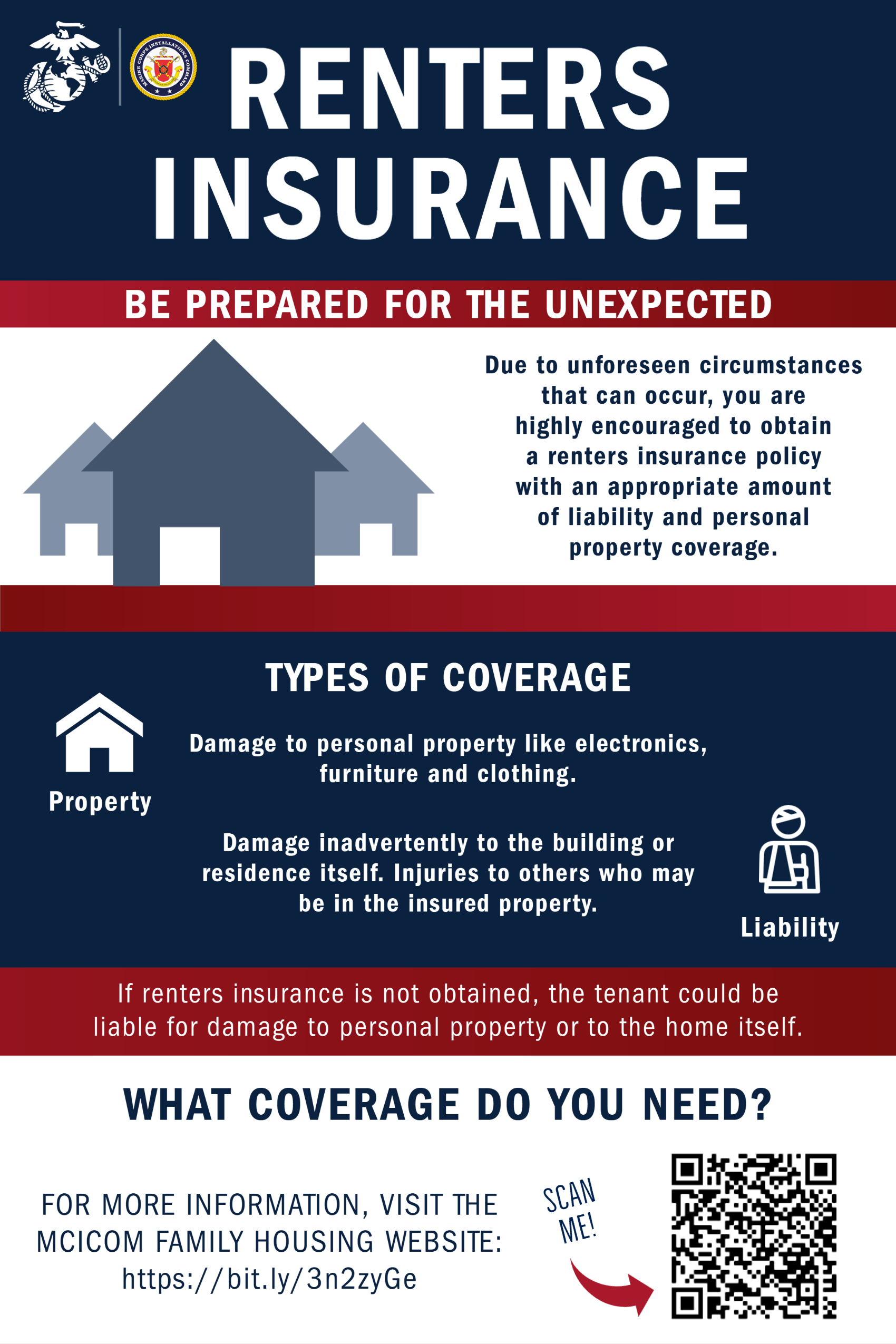

Renters insurance is a crucial yet often overlooked aspect of protecting your belongings and peace of mind as a tenant. It provides coverage for a variety of unforeseen events, such as theft, fire, or water damage, ensuring that your personal possessions are safeguarded. Typically, renters insurance includes three main types of coverage: personal property coverage, liability coverage, and additional living expenses. Personal property coverage helps replace belongings like electronics, clothing, and furniture if they are damaged or lost due to a covered event. Liability coverage protects you in case someone is injured in your rented space, covering legal fees and medical expenses, while additional living expenses provide support for temporary housing if your rental becomes uninhabitable.

Understanding the importance of renters insurance can save you from significant financial stress in unexpected situations. Many landlords require tenants to have this insurance to mitigate risks. Without it, you could be left to bear the costs of replacing your belongings or facing legal claims on your own. Investing in renters insurance is often very affordable and can provide invaluable protection, giving you peace of mind as you enjoy your home. Remember, while your landlord's insurance may cover the building itself, it does not extend to your personal property. Therefore, having your own policy is not just a smart move; it's essential for your financial well-being.

Is Renters Insurance Worth It? Debunking Common Myths

Many renters often ponder, is renters insurance worth it? This essential coverage can provide significant peace of mind, yet several myths can cloud its true value. One common misconception is that renters insurance is only necessary for high-value items. In reality, even modest possessions can add up quickly; when you consider electronics, furniture, and clothing, the total can easily exceed thousands of dollars. Furthermore, renters insurance typically covers personal liability and additional living expenses in case of emergencies, making it a comprehensive safety net.

Another myth is that renters insurance is too expensive. In fact, the average cost of renters insurance is quite affordable, often less than a monthly dinner out. Many policies can be tailored to fit various budgets while still providing adequate coverage. Additionally, various discounts are available for safety features like smoke detectors or security systems. Weighing the cost of renters insurance against the potential financial loss from theft, fire, or natural disasters reveals that the investment is not only worthwhile, but smart.