Pulse of Information

Stay updated with the latest news and insights.

Quote Me If You Can: Navigating the Insurance Jungle

Unlock the secrets of insurance with expert tips and insightful quotes to guide you through the jungle. Navigate with confidence!

Understanding Insurance Terminology: A Beginner's Guide

Understanding insurance terminology is crucial for anyone looking to navigate the complex world of insurance policies. Terminology can often be confusing for beginners, leading to misunderstandings and potentially costly mistakes. Some key terms to familiarize yourself with include premium, which is the amount paid for an insurance policy, and deductible, the amount you must pay out-of-pocket before your insurance kicks in. Additionally, knowing what coverage entails—essentially, what risks or damages your policy will protect you against—is fundamental for choosing the right plan.

Moreover, understanding the different types of coverage options can help you make informed decisions. For example, liability insurance protects you against claims resulting from injuries and damage to people or property, while comprehensive coverage can cover non-collision-related incidents. You might also come across terms like endorsement, which refers to modifications made to an original insurance contract, and exclusions, which detail what is not covered by your policy. By grasping these foundational concepts, you'll be better prepared to choose an insurance policy that meets your needs.

Top 5 Common Myths About Insurance Debunked

When it comes to insurance, there are numerous misconceptions that can lead to confusion and poor decision-making. One prevalent myth is that insurance is a waste of money. Many people believe that if they never file a claim, the premiums they pay are just lost expenses. However, insurance is a vital financial safety net designed to protect you from significant losses, offering peace of mind in times of need. Without it, a single accident or disaster could lead to overwhelming financial burdens.

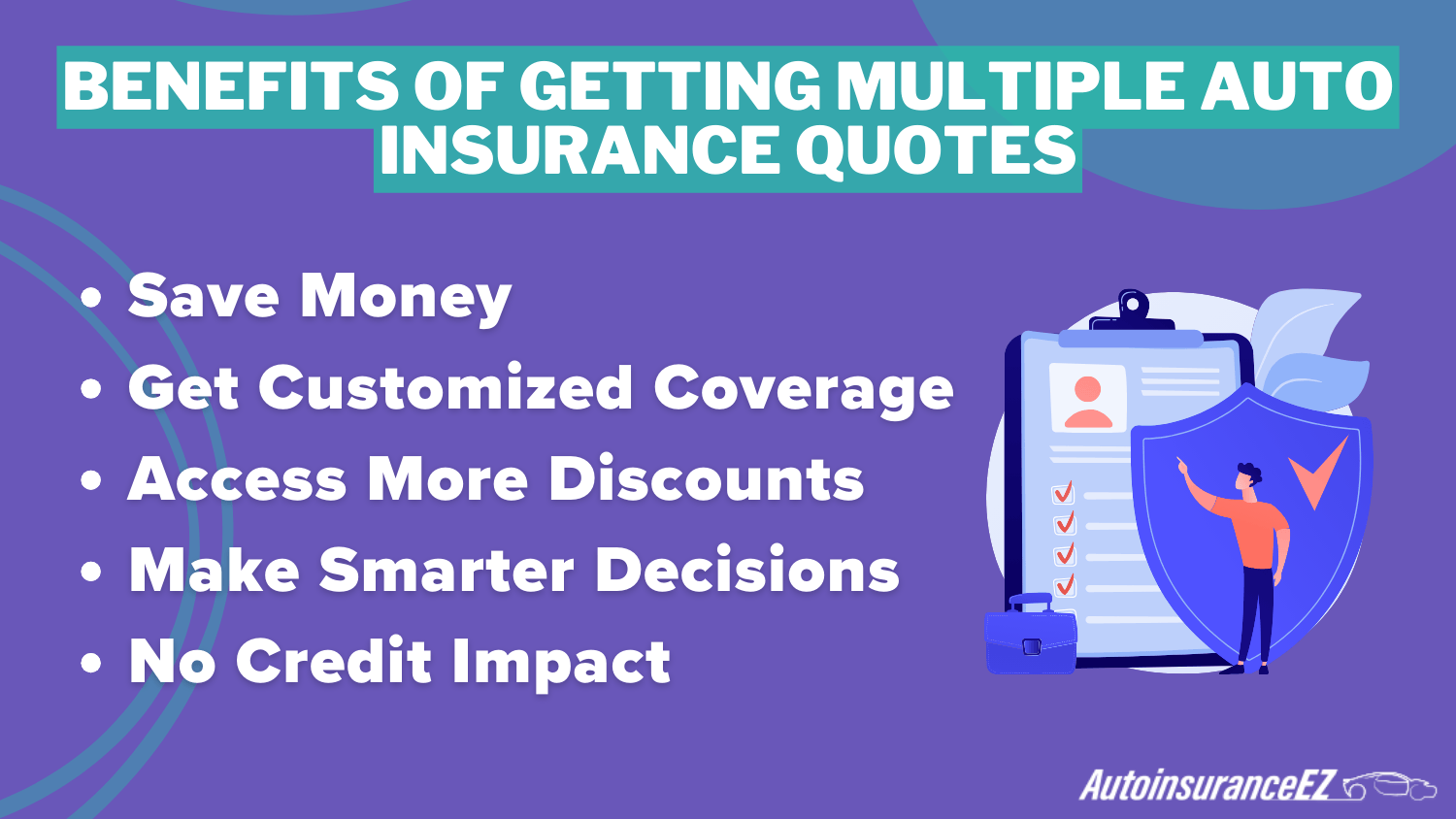

Another common myth is that all insurance policies are the same. In reality, insurance policies vary significantly in coverage, exclusions, and costs. For example, auto insurance can differ vastly based on the provider, coverage limits, and your driving record. It’s crucial to research and compare different policies to ensure you are adequately protected and getting the best value for your money. Always remember, understanding your coverage is key to making informed choices.

How to Choose the Right Insurance Policy for Your Needs

Choosing the right insurance policy for your needs can be a daunting task, but it is crucial for protecting your financial future. Start by assessing your specific requirements. Consider factors such as your age, health status, lifestyle, and existing financial obligations. For example, if you have a family to support, a comprehensive life insurance policy might be essential. Similarly, if you own a home, a robust homeowner's insurance can safeguard your investment against unforeseen events.

Once you have a clear understanding of your needs, it's time to compare different insurance policies. Look for policies that offer the coverage you require at prices that align with your budget. Utilize online comparison tools or consult with a knowledgeable insurance agent to explore various options. Remember to read the fine print; understanding the terms, premiums, deductibles, and exclusions is vital to making an informed decision. Ultimately, choose a policy that provides peace of mind, knowing you are well-protected against potential risks.