Pulse of Information

Your source for the latest insights and updates.

Term Life Insurance: Because Life is Full of Surprises

Secure your loved ones' future! Discover how term life insurance can protect them from life's unexpected twists and turns.

Understanding the Basics of Term Life Insurance: What You Need to Know

Term life insurance is a straightforward and affordable option for individuals seeking financial security for their loved ones in the event of an untimely death. Unlike whole life insurance, which provides coverage for the insured's entire life, term life insurance only offers protection for a specified period—typically ranging from 10 to 30 years. This coverage is designed to provide a financial safety net, ensuring that your beneficiaries can cover essential expenses such as mortgage payments, children's education, and daily living costs. Understanding the duration of your coverage and selecting the right term length is crucial to maximizing the benefits of your policy.

When considering term life insurance, it's important to evaluate various factors, including your current financial obligations, future goals, and budget. Many policies also offer a conversion option, allowing you to switch to a permanent policy without undergoing a medical exam if your needs change. Additionally, premiums are typically lower for younger, healthier individuals, making it an opportune time to secure coverage. As you navigate the world of life insurance, keeping these essentials in mind will empower you to make informed decisions that protect your family's future.

Top 5 Reasons to Choose Term Life Insurance for Your Family's Financial Security

When considering the financial security of your family, term life insurance emerges as an excellent choice for numerous reasons. Firstly, it offers a cost-effective way to secure a substantial death benefit, which can significantly alleviate your family's financial burden in the event of your untimely passing. The premiums for term life insurance are generally lower compared to permanent life insurance options, making it particularly suitable for young families on a budget. This affordability allows you to obtain adequate coverage during your working years when your dependents rely on your income the most.

Secondly, term life insurance provides flexibility tailored to your family's specific needs. Policies are available in various term lengths, typically ranging from 10 to 30 years, allowing you to choose a duration that covers critical financial milestones, such as raising children or paying off a mortgage. Additionally, many policies offer the option to convert to permanent insurance later on, ensuring that you can adapt your coverage as your family's financial situation evolves. In summary, choosing term life insurance gives you peace of mind, knowing your loved ones' financial future is protected without breaking the bank.

Is Term Life Insurance Right for You? Common Questions Answered

Term life insurance can be a pivotal financial tool for those looking to secure their family's future. Many individuals wonder, 'Is term life insurance right for me?' The answer often hinges on personal circumstances, including age, health status, and financial responsibilities. Term life insurance is designed to provide coverage for a specific period, often ranging from 10 to 30 years, and can be a more affordable option compared to whole life insurance. It's particularly beneficial for individuals with dependent family members, as it ensures financial protection during critical years, allowing for stability in case of an untimely passing.

When considering term life insurance, potential policyholders frequently have essential questions, such as:

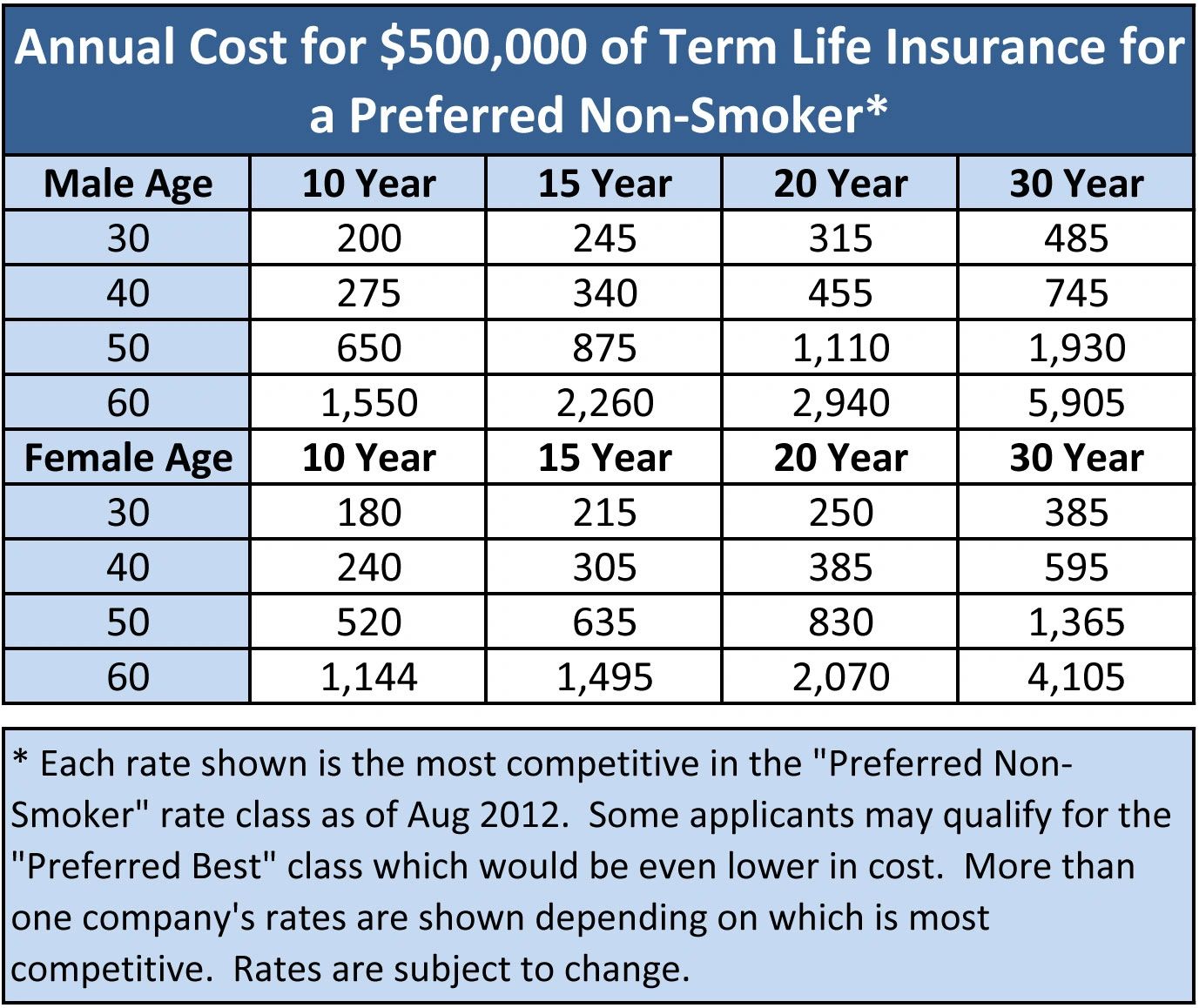

- What factors determine my premium rates?

- How long should I choose for the term length?

- Can I convert my policy to permanent insurance?

Understanding these aspects can help you make an informed decision. Generally, premiums are influenced by age, health history, and lifestyle choices, while the term length will depend on how long you expect dependents to rely on your income. Consulting with a financial advisor can provide personalized insights that align with your financial goals.