Pulse of Information

Your source for the latest insights and updates.

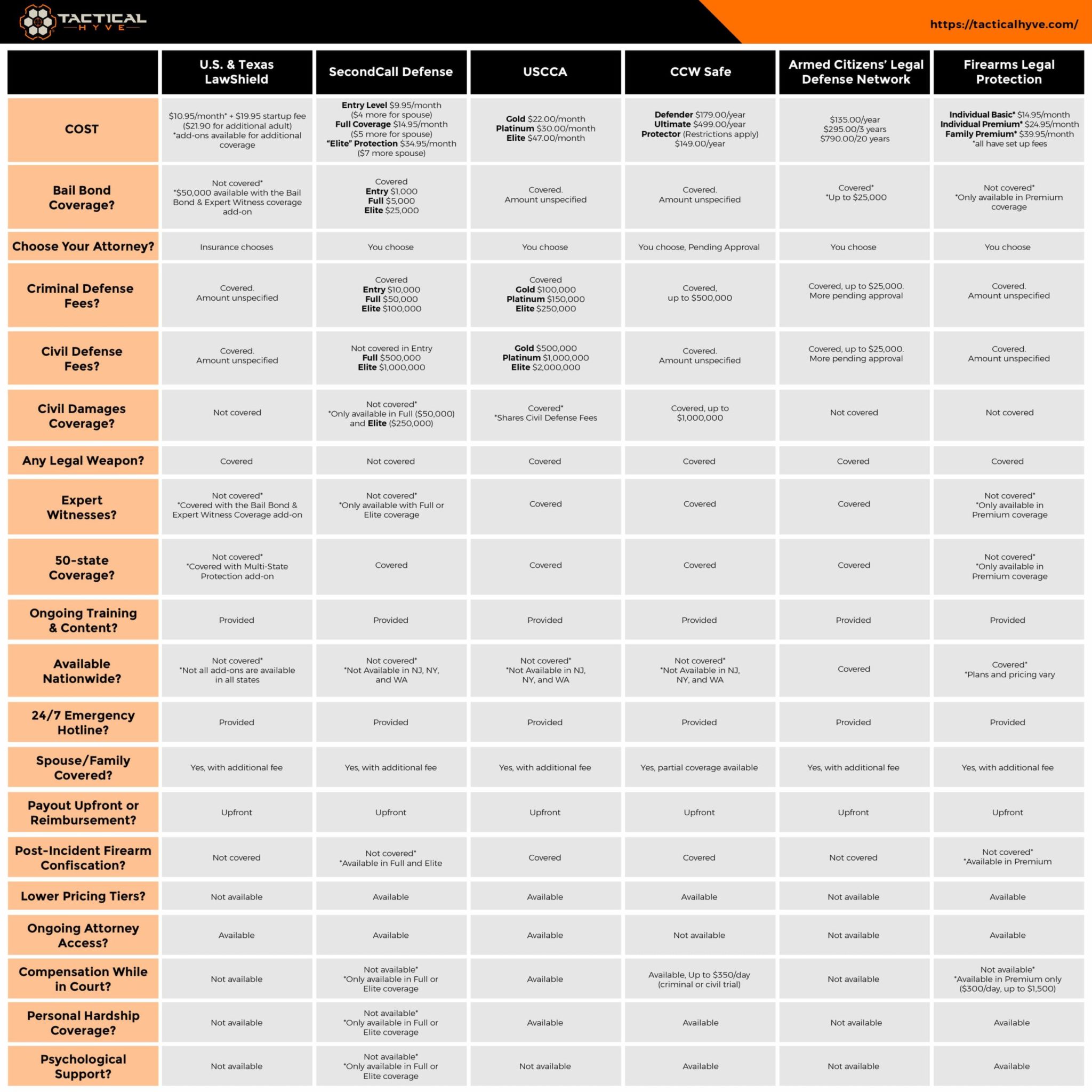

Insurance Showdown: Finding Your Perfect Match

Discover the ultimate guide to insurance choices! Uncover tips to find your perfect policy match and save big today!

Understanding Different Types of Insurance: Which One is Right for You?

Understanding different types of insurance can be a daunting task, especially with the myriad of options available. From health insurance to auto and home policies, each type serves a specific purpose and offers unique benefits. For instance, health insurance is crucial for covering medical expenses, while auto insurance protects against damages and liabilities associated with vehicle ownership. It is essential to evaluate your personal circumstances, financial situation, and individual needs when deciding which type of insurance is right for you.

To help in your decision-making process, consider the following factors when choosing an insurance policy:

- Your Lifestyle: Assess your daily activities and potential risks. For example, if you live in a flood-prone area, flood insurance may be necessary.

- Your Assets: Determine the value of your possessions. Renters may need renter's insurance to protect personal belongings, while homeowners should consider homeowner's insurance as a safeguard against damages.

- Your Financial Situation: Evaluate your budget for monthly premiums and out-of-pocket expenses, ensuring that the coverage fits your financial plan.

Top 5 Factors to Consider When Choosing Your Insurance Plan

Choosing the right insurance plan can be a daunting task, but understanding the top factors to consider can simplify the process. First and foremost, you should assess your coverage needs. Different individuals and families have varying requirements based on their health, lifestyle, and financial situations. For example, someone with chronic health conditions may prioritize comprehensive coverage, while a healthy individual might opt for a plan with lower premiums and higher deductibles.

Another crucial factor is the cost of the premiums. While staying within your budget is important, you should also consider what services and coverage are included in the plan. Compare the options available on the market to ensure that you are getting value for your money. Additionally, pay attention to network restrictions as well; some plans may limit your choice of doctors and hospitals, which could impact your access to care. Lastly, take time to read reviews and understand the customer service reputation of the insurance provider, as this can significantly affect your experience in the long run.

Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, myths can cloud your judgment and lead to costly mistakes. One common misconception is that insurance policies are one-size-fits-all. In reality, different individuals and businesses have unique needs that must be addressed. For instance, while you may think your home is automatically covered for all types of damage, many policies exclude natural disasters like floods or earthquakes. To avoid surprises at claim time, it's essential to read your policy carefully and consult with an insurance agent regarding your specific circumstances.

Another prevalent myth is that insurance is unnecessary if you're young and healthy. Many believe they can defer purchasing health or life insurance until they grow older and start a family. However, this could be a costly mistake. Rates are generally more affordable for younger individuals, and securing coverage early ensures you have it when you need it the most. Furthermore, unforeseen accidents or illnesses can strike at any age, making it vital to have a solid plan in place. Don't wait for the unexpected to occur; educate yourself on insurance options available to you today.