Pulse of Information

Your source for the latest insights and updates.

Life Insurance: The Safety Net You Didn't Know You Needed

Discover why life insurance is the ultimate safety net you never knew you needed. Secure your future today!

Understanding the Basics: What You Need to Know About Life Insurance

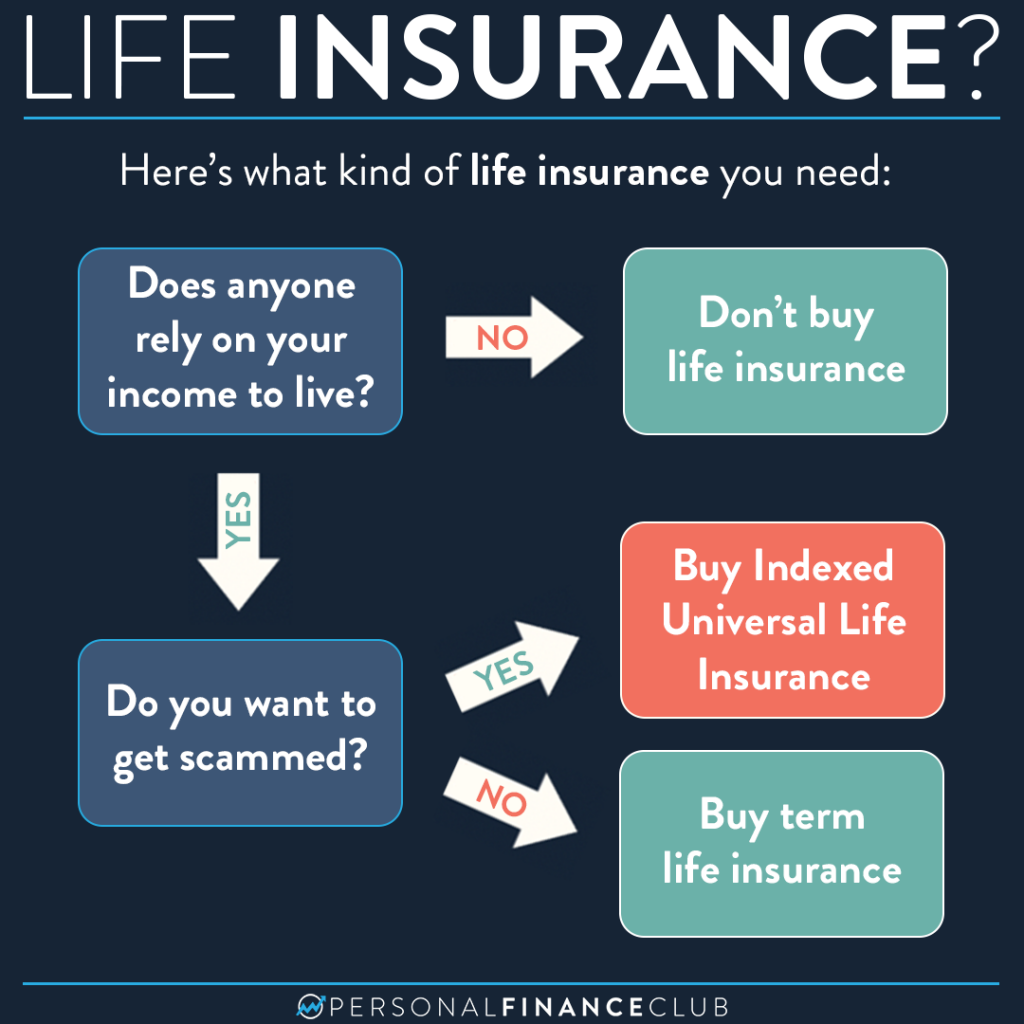

Life insurance is a financial product designed to provide peace of mind and a safety net for your loved ones in the event of your untimely demise. Understanding the basics of life insurance can help you make informed decisions about your coverage needs. At its core, life insurance offers a death benefit to the beneficiaries you designate, ensuring that they can maintain their standard of living, cover debts, and manage expenses like education and housing. There are two main types of life insurance: term life insurance, which provides coverage for a specific period, and permanent life insurance, which covers you for your entire life, as long as premiums are paid.

When considering life insurance, it's important to evaluate your individual needs and circumstances. Factors such as your age, health, income, and family situation play a crucial role in determining the amount of coverage you might require. Here are some key points to consider:

- Assess your financial obligations: Calculate debts, mortgage payments, and future expenses to determine how much coverage is necessary.

- Consider your dependents: Think about who relies on your income and how they would fare without it.

- Review different policies: Compare different life insurance options to find the one that offers the best balance of cost and coverage.

Is Life Insurance Right for You? Top Questions Answered

Deciding whether life insurance is right for you can feel overwhelming, but asking the right questions can help clarify your needs. First, consider your financial obligations. Do you have dependents, a mortgage, or other debts? These responsibilities can influence the amount and type of insurance you might need. Additionally, think about your long-term goals. Would you like to leave an inheritance for your children or cover funeral costs? Understanding your financial landscape is crucial in making an informed decision about life insurance.

Another important factor is your health and age. Generally, the younger and healthier you are, the better premiums you can secure. Ask yourself: When do I plan to start a family? or What are my current health conditions? These considerations can affect your eligibility and rates. Finally, evaluate the different types of life insurance available: term, whole, or universal. Each type has its distinct benefits and drawbacks, so familiarizing yourself with them can go a long way in determining the best fit for your situation.

The Hidden Benefits of Life Insurance: More Than Just Financial Security

When most people think of life insurance, the immediate association is often financial security. While providing a safety net for your loved ones in the event of your passing is a crucial aspect, there are several hidden benefits that many individuals overlook. For instance, life insurance can serve as a valuable tool for wealth accumulation. Permanent life insurance policies, such as whole life or universal life, build cash value over time, which can be borrowed against or withdrawn if needed. This feature can supplement retirement income or serve as an emergency fund, illustrating that life insurance is not merely a protective measure but a versatile financial instrument.

Moreover, life insurance can play a significant role in your overall estate planning strategy. It can help cover estate taxes, ensuring that your heirs receive a larger portion of your assets without the burden of hefty tax liabilities. Additionally, the death benefit from a life insurance policy is typically paid out free from tax, allowing beneficiaries to utilize these funds as they see fit. This can provide them not only with financial security, but also the freedom to grieve and manage their affairs without the immediate pressure of financial concerns. Thus, the benefits of life insurance extend well beyond its traditional role, making it a crucial component of a holistic financial plan.