Pulse of Information

Your source for the latest insights and updates.

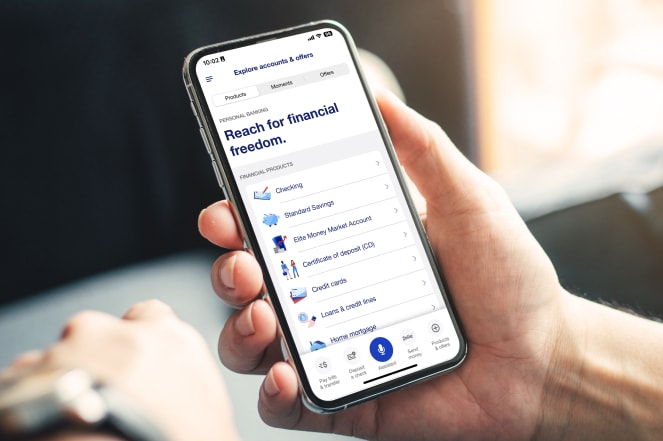

Banking Secrets Your Bank Doesn't Want You to Know

Unlock hidden banking secrets that could save you money! Discover what your bank doesn't want you to know. Don't miss out!

5 Hidden Fees Your Bank Doesn't Want You to Know About

Many people assume that the fees associated with their bank accounts are straightforward, but hidden fees can lurk beneath the surface, often catching customers off guard. One common hidden fee is the monthly maintenance fee, which banks may charge if your balance falls below a certain threshold. This fee can chip away at your savings, especially if you're not aware of it. Additionally, ATM fees can accumulate quickly if you frequently withdraw cash from machines outside of your bank's network; each transaction can incur a fee from both your bank and the ATM operator, leading to unexpected charges.

Another often-overlooked fee is the overdraft protection fee. While this service can help you avoid declined transactions, the associated fees can add up, sometimes reaching $35 or more per incident. Similarly, foreign transaction fees can apply during international purchases or ATM withdrawals, leading to an unexpected percentage charge on your transactions. Lastly, many banks impose inactivity fees, penalizing accounts that have little to no activity for a certain period. It's crucial to review your bank's fee structure regularly to ensure you're not losing money to these hidden charges.

How to Maximize Your Savings: Secrets Banks Don’t Tell You

When it comes to maximizing your savings, understanding the secrets banks don’t tell you can make a significant difference. First and foremost, take advantage of high-yield savings accounts. These accounts typically offer interest rates that are much higher than traditional savings accounts, allowing your money to grow faster. Additionally, consider setting up automatic transfers from your checking to your savings account. This not only simplifies the saving process but also helps you avoid the temptation to spend your disposable income.

Another important strategy is to consistently monitor your savings for fees that may eat into your earnings. Many banks impose maintenance fees on their accounts; however, often you can have these waived by maintaining a minimum balance or by opting for an account with no fees. Additionally, don't hesitate to shop around for better rates and promotions at different banks, as the interest rates can vary significantly. By implementing these banking secrets, you can not only increase your savings but also enhance your financial security.

Do You Really Understand Your Bank Statement? Uncovering the Truth

Understanding your bank statement is crucial for managing your finances effectively. Many people glance through their statements without fully grasping the multiple elements included. A bank statement typically contains a summary of your account activity over a specific period, including deposits, withdrawals, fees, and interest earned. To help you better understand your statement, it's essential to read each section thoroughly and familiarize yourself with the abbreviations and codes used. This attention to detail can reveal insights into your spending habits and highlight areas where you can cut back.

Moreover, discrepancies and unexpected charges can arise, leading to confusion and frustration. If you find a transaction that doesn't seem correct, addressing it promptly is essential. Most banks provide a detailed breakdown of each transaction, often linking back to the source of the charge. By understanding your bank statement and questioning any anomalies, you enhance your financial literacy and can take actionable steps towards a healthier financial future. Remember, being informed empowers you to make better decisions and avoid potential pitfalls.