Pulse of Information

Your source for the latest insights and updates.

Cheap Insurance: Because Who Needs a Budget Anyway?

Discover how to save big on insurance without breaking the bank! Affordable options await—who needs a budget? Click to learn more!

Understanding the Basics of Cheap Insurance: What to Look For

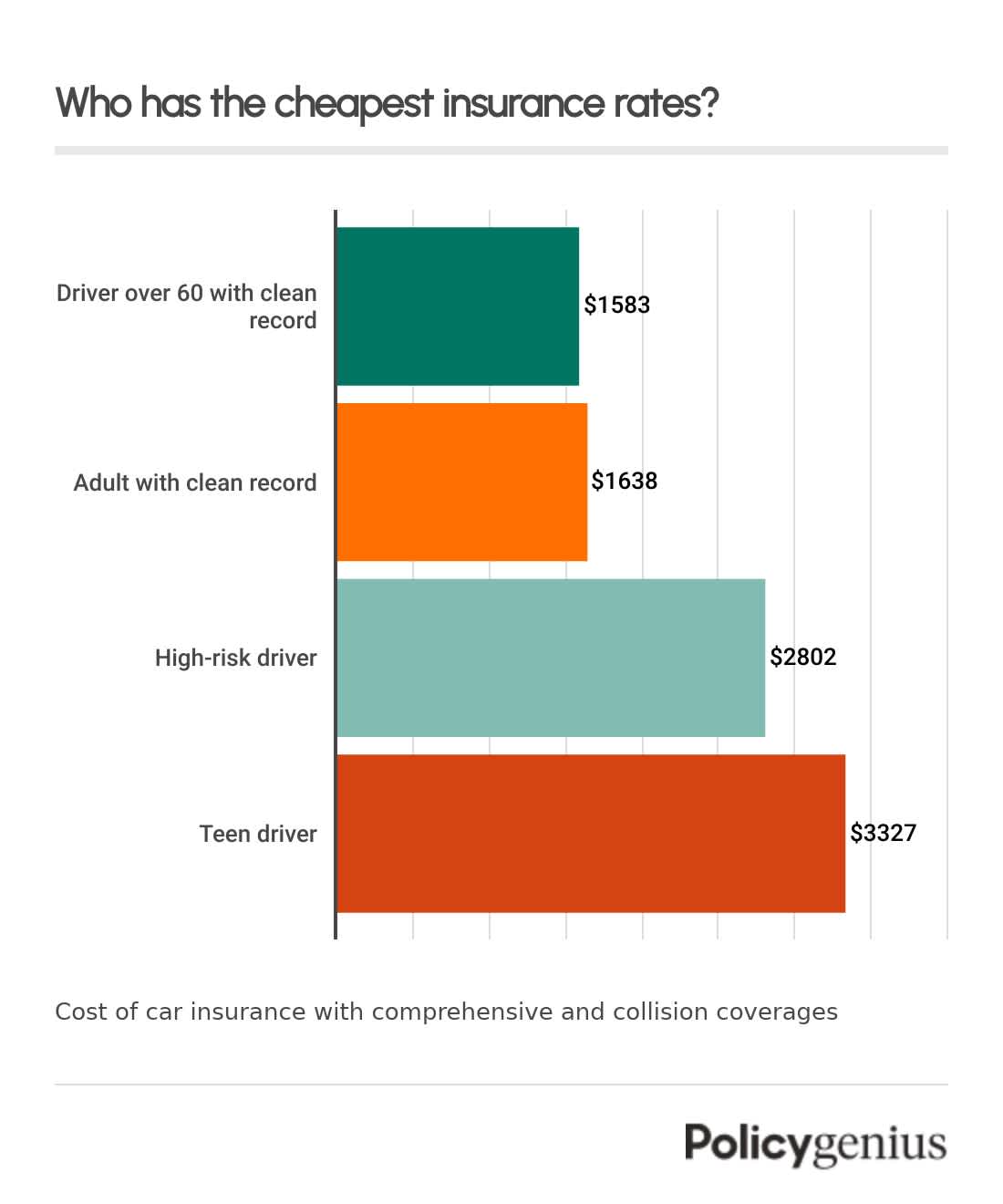

When searching for cheap insurance, it’s essential to grasp the fundamentals of what qualifies as affordable coverage without sacrificing necessary protection. Begin by identifying your specific needs – whether it's auto, home, or health insurance. Different policies offer varying levels of coverage and deductible amounts, so understanding your personal requirements will help you avoid overspending on unnecessary features. Compare multiple quotes from various providers to ensure you are getting a competitive rate, and consider investigating any discounts available, such as bundling multiple policies or maintaining a good driving record.

Another crucial aspect when assessing cheap insurance is to read the fine print. Many policies may appear cost-effective at first glance, but hidden fees and exclusions could lead to significant expenses in the future. Look for customer reviews and ratings to gauge the insurer’s reliability and customer service performance. Additionally, check the financial stability of the company; a well-rated insurer may provide peace of mind, knowing they can pay claims when necessary. Ultimately, understanding the balance between cost and coverage will empower you to make informed decisions and secure the best possible policy.

Is Cheap Insurance Worth It? Pros and Cons Explained

When considering cheap insurance, it’s essential to weigh the benefits against potential drawbacks. One major advantage is the cost savings. Consumers can save significantly on their monthly premiums, allowing for better allocation of their budget. Moreover, many low-cost insurance policies offer basic coverage, which may be sufficient for those seeking minimal protection. However, it’s crucial to assess the coverage limits, as cheaper policies often come with higher deductibles and restrictions that could leave you vulnerable to financial strain in the event of an accident or damage.

On the flip side, the disadvantages of opting for cheap insurance can be daunting. Typically, lower premiums are associated with limited coverage options, which may exclude essential benefits that more comprehensive policies provide. Additionally, the claims process can be more cumbersome, with insurance companies often providing less customer support when it comes to processing claims. Always thoroughly read the policy details and consider if the savings are worth the potential risks involved in settling for inexpensive coverage.

Top Tips for Finding Affordable Insurance Without Sacrificing Coverage

Finding affordable insurance while ensuring you get the necessary coverage can be a challenging task. Start by comparing multiple quotes from different providers. Use online comparison tools to evaluate premiums alongside coverage options. Each insurer has a unique pricing strategy, and by obtaining multiple quotes, you can identify which offers give you the best value. Additionally, consider bundling policies, such as combining auto and home insurance, which often leads to significant discounts.

Another effective approach is to reevaluate your coverage needs periodically. As life circumstances change, your insurance needs may evolve. For instance, if your car has depreciated in value, dropping comprehensive coverage could save you money. Furthermore, don't hesitate to ask insurers about available discounts for things like safe driving, low mileage, or maintaining a good credit score. By being proactive and informed, you can achieve the perfect balance of affordability and coverage.