Pulse of Information

Stay updated with the latest news and insights.

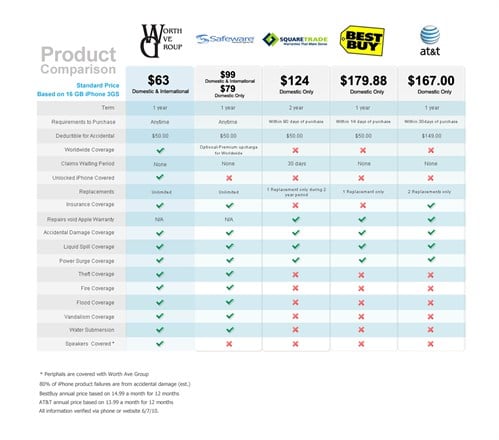

Comparison Games: Find Your Best Insurance Match

Discover the ultimate guide to compare insurance plans and find the perfect match for your needs. Save money and get peace of mind today!

Understanding Insurance Types: Which One is Right for You?

When navigating the world of insurance, it's crucial to understand the various insurance types available to you. Each type serves a specific purpose and can protect you in different situations. For instance, health insurance provides coverage for medical expenses, while auto insurance protects against losses related to vehicle accidents. Additionally, homeowners insurance safeguards your property against damage or theft. To determine which insurance type is right for you, consider your personal circumstances, including your assets and potential risks you may face.

To make an informed decision, you should evaluate a few key factors:

- Your lifestyle: Are you frequently traveling or hosting guests in your home?

- Your assets: Do you own a home, a car, or valuable items that need protection?

- Your health: Do you have existing medical conditions that could lead to high medical expenses?

By understanding these factors, you can better assess which insurance type meets your needs best, ensuring you have the right coverage to protect what matters most to you.

Top 5 Factors to Consider When Comparing Insurance Policies

When comparing insurance policies, it's essential to consider several key factors to ensure you choose the best option for your needs. First and foremost, premium costs should be evaluated. Understanding how much you can afford to pay monthly or annually can greatly impact your decision. Additionally, examine the deductibles associated with each policy, as a higher deductible often translates to lower premium costs, but also means more out-of-pocket expenses when you need to file a claim.

Another crucial factor is the coverage limits offered by each policy. It's important to verify that the policy provides sufficient coverage for your specific needs, whether it be for your home, health, or auto insurance. Inclusions and exclusions also play a significant role, so take the time to read the fine print to understand what is and isn’t covered. Don't forget to consider the insurance provider’s reputation and customer service reviews, as these can greatly influence your experience during claims processing.

How to Use Comparison Games to Find Your Best Insurance Match

Finding the right insurance can often feel overwhelming, but utilizing comparison games can simplify the process significantly. These games allow you to evaluate multiple insurance policies side by side, helping you to understand the differences in coverage, premiums, and deductibles. To get started, list your insurance needs, which may include various factors such as the type of coverage you desire, your budget, and any specific features that are important to you. From there, you can use online comparison tools or mobile apps designed for this purpose.

Once you've gathered a selection of policies, engage with comparison games by answering a series of potential scenarios. For example, you could ask yourself how a particular policy would perform in the event of a claim or analyze customer reviews to see how well each insurer services its clients. By playing these comparison games, you take an interactive approach to understanding the options at hand, which can significantly clarify your decision-making process and ultimately lead you to your best insurance match.