Pulse of Information

Stay updated with the latest news and insights.

Disability Insurance: Your Safety Net in a High-Risk World

Discover how disability insurance can protect your finances and give you peace of mind in an unpredictable world. Don't leave your future to chance!

Understanding Disability Insurance: What You Need to Know

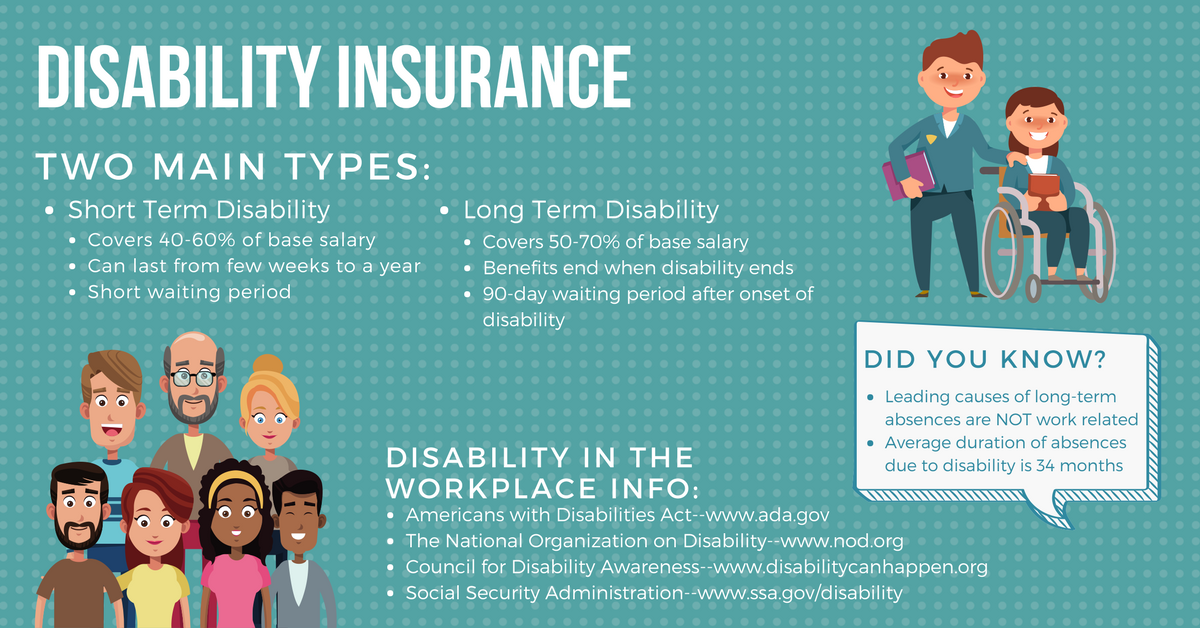

Understanding Disability Insurance is essential for anyone looking to protect their income and financial future in the event of an unforeseen accident or illness. This type of insurance provides financial support when a policyholder is unable to work due to a disability, ensuring that essential living expenses such as mortgages, bills, and medical costs can still be managed. There are two primary types of disability insurance: short-term and long-term. Short-term disability insurance typically covers a portion of your income for a limited period, while long-term disability insurance can provide extended coverage, often lasting years or even until retirement age.

When considering disability insurance, it's crucial to assess your individual needs and the specific terms of the policy. Key factors to consider include the benefit amount, waiting period, and the duration of payments. Additionally, understanding the definitions of disability in your policy is vital, as some policies may only cover certain types of disabilities. To make an informed decision, you may want to compare different policies and consult with a financial advisor or insurance professional who can help you navigate the complexities of the coverage options available to you.

Top 5 Reasons Why Disability Insurance is Essential for Everyone

Disability insurance is a financial safety net that provides income replacement in the event of a disabling injury or illness. Many people believe that they won't need this type of insurance, especially if they are young and healthy. However, according to various studies, around 1 in 4 individuals will face a disability before reaching retirement age. This highlights the importance of planning for unforeseen circumstances. Here are the top 5 reasons why disability insurance is essential for everyone:

- Income Protection: Disability insurance ensures that you receive a portion of your salary while you're unable to work, helping you pay bills and maintain your lifestyle.

- Peace of Mind: Knowing that you have coverage in place can alleviate anxiety about financial stability in case of unexpected incidents.

- Coverage for Various Disabilities: Disability can arise from accidents, illnesses, or chronic conditions, and having a policy means you're protected regardless of the cause.

- Rising Medical Costs: Medical expenses can accumulate rapidly in the event of a disability, and having disability insurance can help cover those costs.

- Employer Coverage Limitations: Relying solely on employer-provided disability coverage may not be sufficient, as it often doesn't replace all lost income.

Is Disability Insurance Worth It? Exploring the Benefits and Risks

When considering whether disability insurance is worth it, it's essential to weigh the potential benefits against the associated costs. Disability insurance provides financial security in the event that an individual becomes unable to work due to illness or injury. This coverage can be especially crucial for those who rely heavily on their income to support themselves or their families. According to a study, approximately 1 in 4 Americans will experience a disability during their working years, making the protection offered by disability insurance a valuable consideration for many.

However, there are also risks to consider when purchasing disability insurance. The primary concern is the cost; premiums can be expensive, and some policies may not provide comprehensive coverage. Additionally, many policies come with waiting periods and exclusions that can impact the benefits received. It's important for individuals to carefully review the terms of any policy and assess their own risk factors, such as occupation and health status, before making a decision. Ultimately, understanding both the benefits and risks can help individuals determine if investing in disability insurance is the right choice for their personal circumstances.