Pulse of Information

Your source for the latest insights and updates.

Disability Insurance: Your Safety Net in Disguise

Unlock your financial freedom with disability insurance—your unseen safety net protecting your future. Find out how it works!

Understanding Disability Insurance: What You Need to Know

Disability insurance is a vital form of protection designed to provide financial stability in the event that you become unable to work due to a disability. It replaces a portion of your income, helping cover essential expenses such as housing, medical bills, and daily living costs. There are two main types of disability insurance: short-term and long-term. Short-term policies typically cover disabilities lasting from a few weeks to up to six months, while long-term policies provide coverage for extended periods, potentially until retirement age. Understanding the differences between these options is crucial for selecting the right plan that meets your individual needs.

When considering disability insurance, it's essential to evaluate key factors such as coverage amount, waiting periods, and definitions of disability. Keep in mind that most policies will replace a percentage of your income, usually around 60% to 70%. Additionally, look for policies that offer a definition of disability that aligns with your profession, as this can significantly impact your benefits. Furthermore, reviewing any exclusions and limitations is important to ensure comprehensive protection. By taking the time to understand these elements, you can make an informed decision that provides peace of mind for you and your family in the face of unexpected challenges.

5 Common Myths about Disability Insurance Debunked

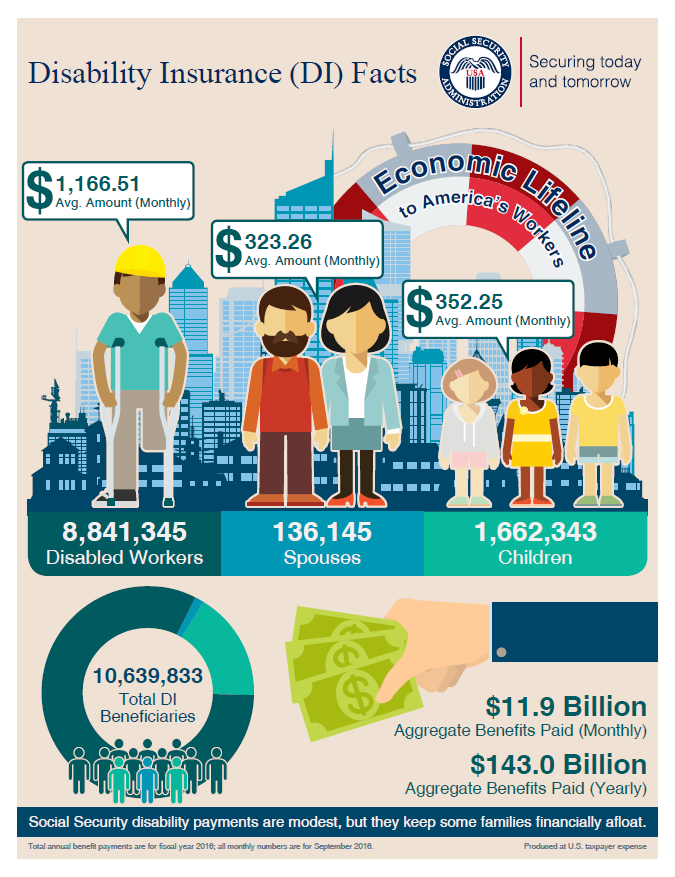

Disability insurance is often surrounded by misconceptions that can lead to confusion and poor decisions. One common myth is that disability insurance is only for those in high-risk jobs. In reality, anyone can become disabled due to illness or injury, regardless of their occupation. According to the Social Security Administration, about 1 in 4 of today’s 20-year-olds will experience a disability before reaching retirement age, highlighting the importance of having coverage for unforeseen circumstances.

Another frequent misconception is that disability insurance will cover all expenses without any limitations. In truth, most policies have specific terms regarding the duration and amount of benefits. Some policies may even have waiting periods before benefits kick in. Understanding these nuances is crucial for selecting the right coverage and ensuring that you’re adequately protected in case of a disability. To debunk these myths, it's essential to research your options and consult with a qualified insurance professional.

Is Disability Insurance Right for You? Key Questions to Consider

When considering whether disability insurance is right for you, it's essential to evaluate your personal and financial circumstances. Start by asking yourself a few key questions:

- What are your current living expenses, and would you be able to manage them without your income?

- Do you have any savings or other sources of income that could support you in the event of a disability?

- How likely are you to become disabled based on your occupation and health history?

Another critical aspect to consider is the type of coverage available. There are generally two main types of disability insurance policies: short-term and long-term.

Short-term disability insurance typically provides benefits for a limited period, while long-term disability insurance can offer support for an extended time, even until retirement age.Evaluate which option aligns better with your financial goals and lifestyle. Don't forget to review the policy's terms, including the waiting period and benefit duration, to ensure you're making an informed decision.