Pulse of Information

Your source for the latest insights and updates.

Insurance Coverage: The Safety Net You Didn't Know You Needed

Discover the hidden power of insurance coverage—your essential safety net for life's unexpected twists! Don't wait until it's too late!

Understanding the Different Types of Insurance Coverage: What You Need to Know

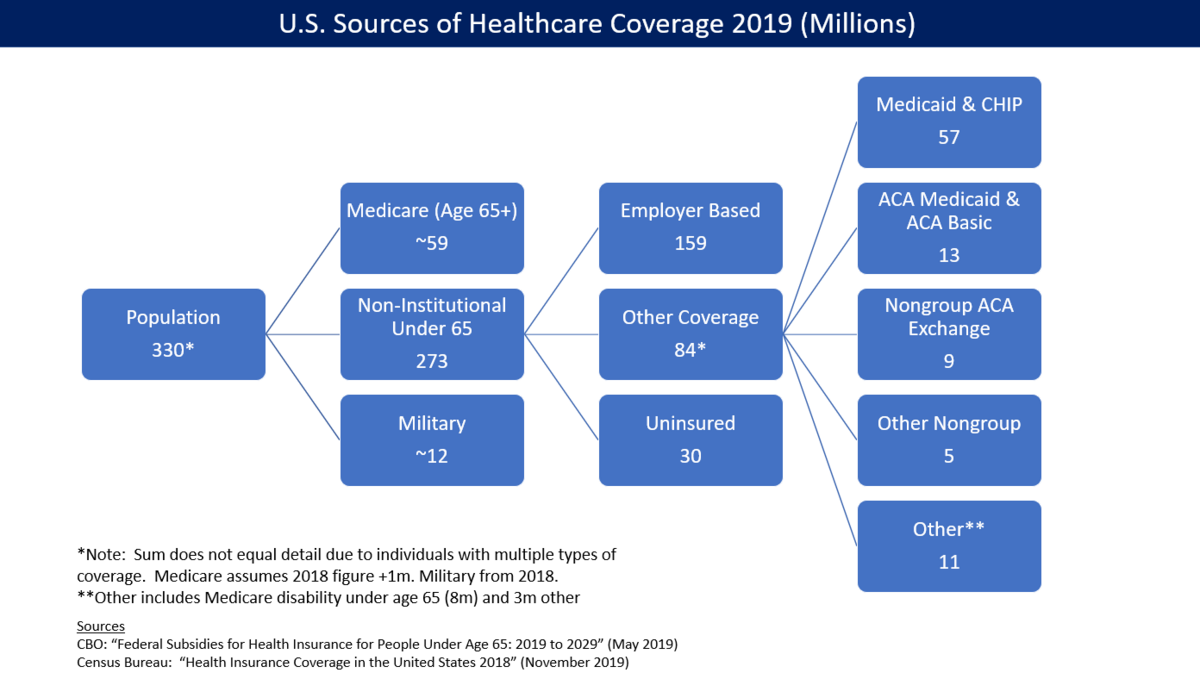

Understanding the different types of insurance coverage is crucial for safeguarding your financial well-being. Insurance coverage can generally be divided into several key categories, including health insurance, auto insurance, homeowners insurance, and life insurance. Each type serves a specific purpose and protects against various risks. For instance, health insurance helps cover medical expenses, while auto insurance provides protection in case of accidents. Knowing these categories enables you to assess your personal needs and select the right policies for your circumstances.

In addition to the main categories, it’s important to explore the subtypes of insurance coverage. For example, within auto insurance, you may encounter liability coverage, collision coverage, and comprehensive coverage. Similarly, homeowners insurance can feature dwelling coverage and personal property coverage. Each subtype represents different levels of protection, so it’s essential to read the fine print and determine what best fits your lifestyle and assets. By understanding both the broad categories and specific types of coverage, you are better equipped to make informed decisions about your insurance needs.

Is Your Insurance Coverage Enough? Common Gaps You Might Not Be Aware Of

Understanding whether your insurance coverage is sufficient is crucial in protecting your assets and well-being. Many individuals may assume that their policy covers everything, but there are often common gaps that remain unnoticed. For instance, basic homeowners insurance typically does not cover flood or earthquake damage, which can lead to catastrophic financial losses if these events occur. Moreover, personal liability coverage might fall short in situations involving rental properties or home-based businesses. To ensure you are adequately covered, it's essential to regularly review your policies and consult with an insurance expert.

Another area where insurance coverage may be lacking is in regard to personal property. Items such as jewelry, art, and collectibles often exceed the coverage limits described in standard policies. Furthermore, many people overlook the importance of umbrella insurance, which provides additional liability coverage beyond the limits of other policies. By considering these factors and addressing any potential coverage gaps, you can significantly enhance your financial security and peace of mind.

How Insurance Coverage Can Protect Your Financial Future: A Comprehensive Guide

Insurance coverage is a crucial element in safeguarding your financial future, offering a buffer against unforeseen events that could otherwise lead to significant financial burdens. Different types of insurance, such as health, life, auto, and homeowners, play distinct roles in protecting your assets and well-being. For instance, health insurance can prevent exorbitant medical bills from crippling your savings, while life insurance ensures that your loved ones are financially protected in the event of your untimely demise. By understanding and leveraging these various insurance policies, you can create a robust financial safety net.

Moreover, it’s essential to regularly review and adjust your insurance coverage to align with your evolving financial situation and lifestyle changes. Considerations such as age, career progression, and family circumstances can influence your coverage needs. To maintain adequate protection, you may want to follow these steps:

- Evaluate your current policies and their coverage limits.

- Assess your existing financial obligations, like mortgages and dependents.

- Consult with an insurance advisor to understand new or updated products.