Pulse of Information

Your source for the latest insights and updates.

Insurance Policies: The Safety Net You Didn’t Know You Needed

Discover why insurance policies are the hidden safety nets you can't afford to ignore. Secure your peace of mind today!

Understanding the Basics: What You Need to Know About Insurance Policies

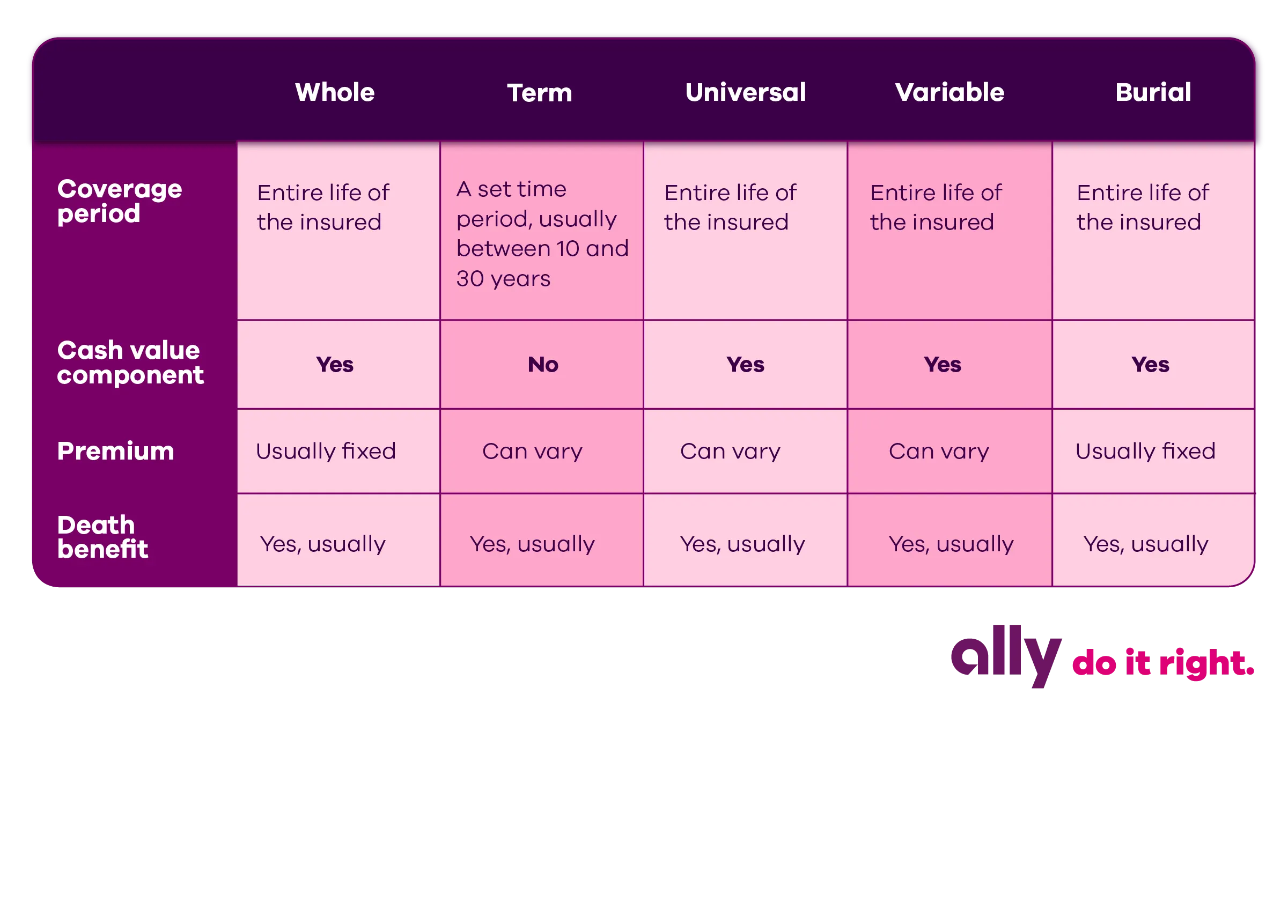

Insurance policies are essential contracts that provide financial protection against unforeseen events. Understanding the basics of these policies is crucial for making informed decisions. There are various types of insurance, including health, auto, life, and home insurance, each designed to cover specific risks. Familiarity with terms like premiums, deductibles, and coverage limits will help you navigate the complex world of insurance. Here's a brief overview of these key concepts:

- Premium: The amount you pay for your insurance policy, typically monthly or annually.

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in.

- Coverage Limit: The maximum amount your policy will pay for a covered loss.

Choosing the right insurance policy can significantly impact your financial stability. It’s important to assess your individual needs and evaluate the different options available. Always read the fine print and ask questions if you're uncertain about any clauses within your policy. Additionally, keeping your policies updated as your life circumstances change—such as getting married, buying a home, or having children—ensures you remain adequately protected. Remember, a well-informed insurance choice not only safeguards your assets but also provides peace of mind.

How to Choose the Right Insurance Policy for Your Needs

Choosing the right insurance policy can seem daunting, but understanding your unique needs is the first step toward making an informed decision. Start by evaluating the types of insurance available—these may include health, auto, home, and life insurance. Consider creating a checklist of your requirements to guide your selection process. This checklist can help you prioritize coverage options, such as:

- Budget constraints

- Specific coverage needs

- Your lifestyle and potential risks

Once you have a clear picture of what you need, it’s time to compare policies. Look for providers that offer customizable options to suit your personal requirements. Pay close attention to the policy limits and deductibles, as these factors significantly impact both your coverage and out-of-pocket expenses. Additionally, to ensure you are getting the best deal, don't hesitate to seek quotes from multiple insurers, and always read customer reviews to gauge satisfaction and reliability.

What Misconceptions Do People Have About Insurance Policies?

There are several misconceptions that people hold regarding insurance policies, often leading to misunderstandings about their coverage and benefits. One common belief is that all insurance policies are too expensive and provide little value. In reality, the cost and benefits can vary significantly depending on individual needs and the type of coverage selected. Many people are unaware that there are numerous options and price points available, including budget-friendly plans that provide essential coverage without breaking the bank.

Another frequent misconception is the idea that once you purchase an insurance policy, you are fully covered for any situation that may arise. However, policies often come with specific exclusions and limitations that can affect how claims are handled. For instance, certain natural disasters or pre-existing conditions may not be covered under standard policies. Therefore, it's essential for policyholders to thoroughly read and understand the terms of their insurance agreement to avoid surprises when they need to file a claim.