Pulse of Information

Stay updated with the latest news and insights.

Insurance Rates Got You Down? Here’s How to Save Big

Discover insider tips to slash your insurance rates and keep more cash in your pocket. Start saving big today!

Top 5 Strategies to Slash Your Insurance Rates

Finding ways to reduce your insurance costs can lead to significant savings over time. Here are 5 strategies you can implement to slash your insurance rates effectively:

- Shop Around: Always compare quotes from different providers. Insurance companies have varying rates, and a simple comparison could save you hundreds.

- Increase Your Deductible: Opting for a higher deductible can lower your premium. However, be sure you can afford the out-of-pocket expense if you need to make a claim.

- Bundle Policies: Consider bundling your home and auto insurance with the same provider. Insurers often offer discounts to customers who consolidate their policies.

Moreover, implementing these additional strategies can further enhance your savings:

- Maintain a Good Credit Score: A better credit rating often leads to lower insurance rates. Pay your bills on time and keep your credit utilization low.

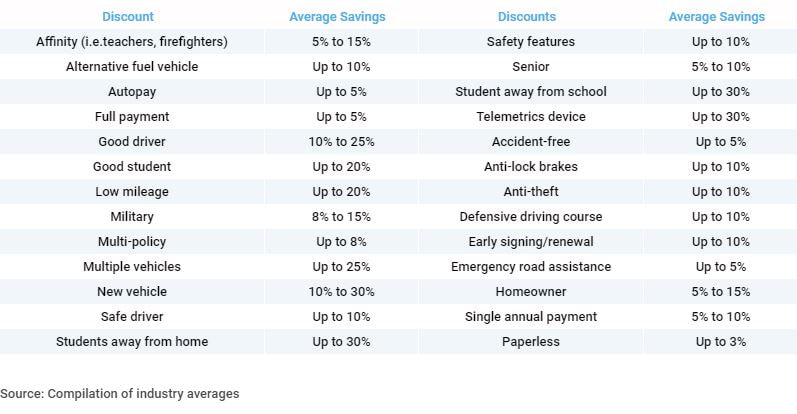

- Take Advantage of Discounts: Many companies offer discounts for being a safe driver, having certain safety features in your vehicle, or even for being a member of specific organizations.

By utilizing these top strategies, you can effectively reduce your insurance expenses and keep more money in your pocket.

Understanding Insurance Premiums: What You Need to Know to Save

Understanding insurance premiums is crucial for anyone looking to manage their finances effectively. An insurance premium is the amount you pay for your insurance policy, and it can be influenced by various factors including your age, health, and the type of coverage you select. To get a better grasp on how these premiums work, it's essential to compare different policies and providers. You should consider factors such as deductibles, co-pays, and coverage limits, as they all play a significant role in determining your overall premium costs.

One effective way to save on insurance premiums is by taking advantage of discounts offered by insurers. For example, many companies provide discounts for bundling multiple policies, such as home and auto insurance. Additionally, maintaining a good credit score and a clean driving record can also contribute to lower premiums. It’s wise to periodically review your policies and shop around for the best rates. Remember, understanding your insurance needs and being proactive can result in significant savings over time.

Are You Paying Too Much? Common Mistakes That Drive Up Insurance Costs

When it comes to insurance, many individuals unknowingly make common mistakes that can significantly increase their premiums. One of the most prevalent errors is failing to shop around for the best rates. Often, people settle for their current provider without comparing quotes from other companies. By not exploring options, you may miss out on better coverage at a lower cost. Additionally, not taking advantage of discounts, such as bundling policies or maintaining a good driving record, can further inflate your expenses.

Another mistake that often drives up insurance costs is underestimating the importance of regular policy reviews. It's essential to reassess your coverage needs and adjust your policy accordingly, especially after major life events such as marriage, purchasing a house, or changing jobs. Ignoring changes in your situation can lead to overinsuring or underinsuring your assets. For instance, if you've recently acquired higher-value items, ensuring they’re covered adequately can save you from financial strain in the event of a loss. Remember, staying informed and proactive is key to avoiding unnecessary expenses!