Pulse of Information

Your source for the latest insights and updates.

Offshore Banks: The Secret Playground for Your Money

Discover how offshore banks can be your ultimate financial playground—maximize privacy, reduce taxes, and unlock wealth potential today!

What Are Offshore Banks and How Do They Work?

Offshore banks are financial institutions located outside of a depositor's country, offering a range of services tailored to the needs of individuals and businesses. One of the main advantages of offshore banking is the potential for financial privacy and asset protection. By keeping assets in an offshore account, depositors may benefit from favorable tax regimes and regulatory environments. These banks cater to a global clientele and provide services such as multi-currency accounts, investment opportunities, and wealth management solutions, making them increasingly attractive to those seeking to diversify their financial portfolios.

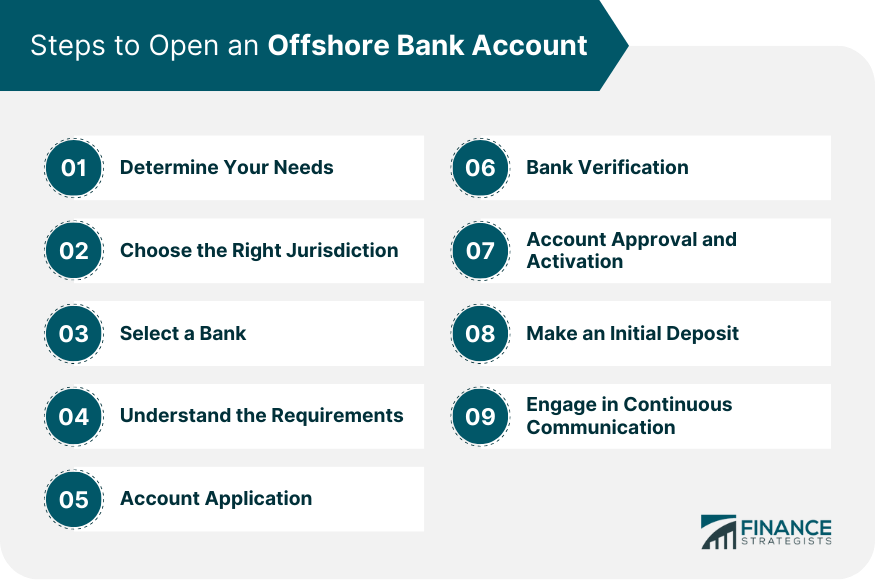

Understanding how offshore banks operate is crucial for anyone considering using their services. Typically, clients can open accounts with minimal documentation, allowing for greater privacy. Offshore banks also offer online banking services, enabling clients to manage their finances conveniently from anywhere in the world. However, it's essential for potential clients to conduct thorough research and ensure compliance with tax regulations in their home countries, as misuse of offshore accounts could lead to legal consequences. By being informed and strategic, individuals can leverage offshore banking to achieve their financial goals while adhering to the law.

Top 5 Reasons to Consider Offshore Banking for Your Wealth

Offshore banking has gained popularity among savvy investors, and for good reason. One of the key advantages of maintaining an offshore account is privacy and confidentiality. Many jurisdictions offer robust legal protections that shield your financial information from unwanted scrutiny, allowing you to manage your wealth discreetly. Furthermore, offshore banks often provide a higher level of customer service, catering to the needs of international clients and offering personalized financial advice tailored to your unique situation.

Another compelling reason to consider offshore banking is the potential for tax optimization. Depending on the jurisdiction, you may benefit from lower tax rates or exemptions that can significantly enhance your overall wealth. Additionally, offshore accounts can provide diversification of assets, helping you to mitigate risks associated with economic downturns in your home country. Overall, these factors make offshore banking a prudent choice for anyone looking to safeguard and grow their wealth.

Is Offshore Banking Right for You? Key Factors to Consider

Offshore banking can offer various advantages, but it's essential to assess whether it's the right fit for your financial situation. One of the primary factors to consider is your financial goals. Are you looking to diversify your investments, protect your assets from potential domestic instability, or perhaps enjoy tax benefits? Each of these motivations may justify the need for an offshore account. Additionally, you should evaluate the legal frameworks and regulations in both your home country and the offshore jurisdiction you're considering. Understanding tax implications and compliance requirements is crucial to ensure you navigate these waters without running afoul of the law.

Another critical aspect involves the types of services offered by offshore banks. Different banks may provide various account types, investment opportunities, and personal banking services. Researching these offerings can help you identify if an offshore bank aligns with your financial strategy. Moreover, consider the reputability of the institution; opt for banks with strong regulatory support and positive customer feedback to ensure your assets are safe. Balancing these factors will enable you to make an informed decision on whether offshore banking is indeed the right move for you.