Pulse of Information

Your source for the latest insights and updates.

Renter's Regrets: Why Skipping Insurance Could Cost You More Than Rent

Discover the shocking costs of skipping renter's insurance—your wallet will thank you! Don't let regrets haunt your next move.

5 Reasons Skipping Renter's Insurance Could Lead to Financial Disaster

Renter's insurance is often overlooked by tenants who believe their belongings are safe without it. However, skipping renter's insurance can lead to significant financial burdens in the event of theft, fire, or other disasters. Without this coverage, tenants are left to pay for their lost or damaged possessions out of pocket. For instance, the average renter has belongings worth thousands of dollars, and replacing them without insurance can quickly deplete savings and lead to debt.

Additionally, many landlords hold tenants responsible for any damages to their property. If an accident, such as a water leak from your apartment, damages neighboring units, you're liable for the repair costs. Renter's insurance can provide liability coverage, shielding you from exorbitant expenses that commonly arise in such situations. Overall, the decision to forgo this critical insurance can easily spiral into financial disaster, leaving tenants vulnerable to unforeseen incidents.

Renter's Insurance Explained: What You Need to Know Before You Rent

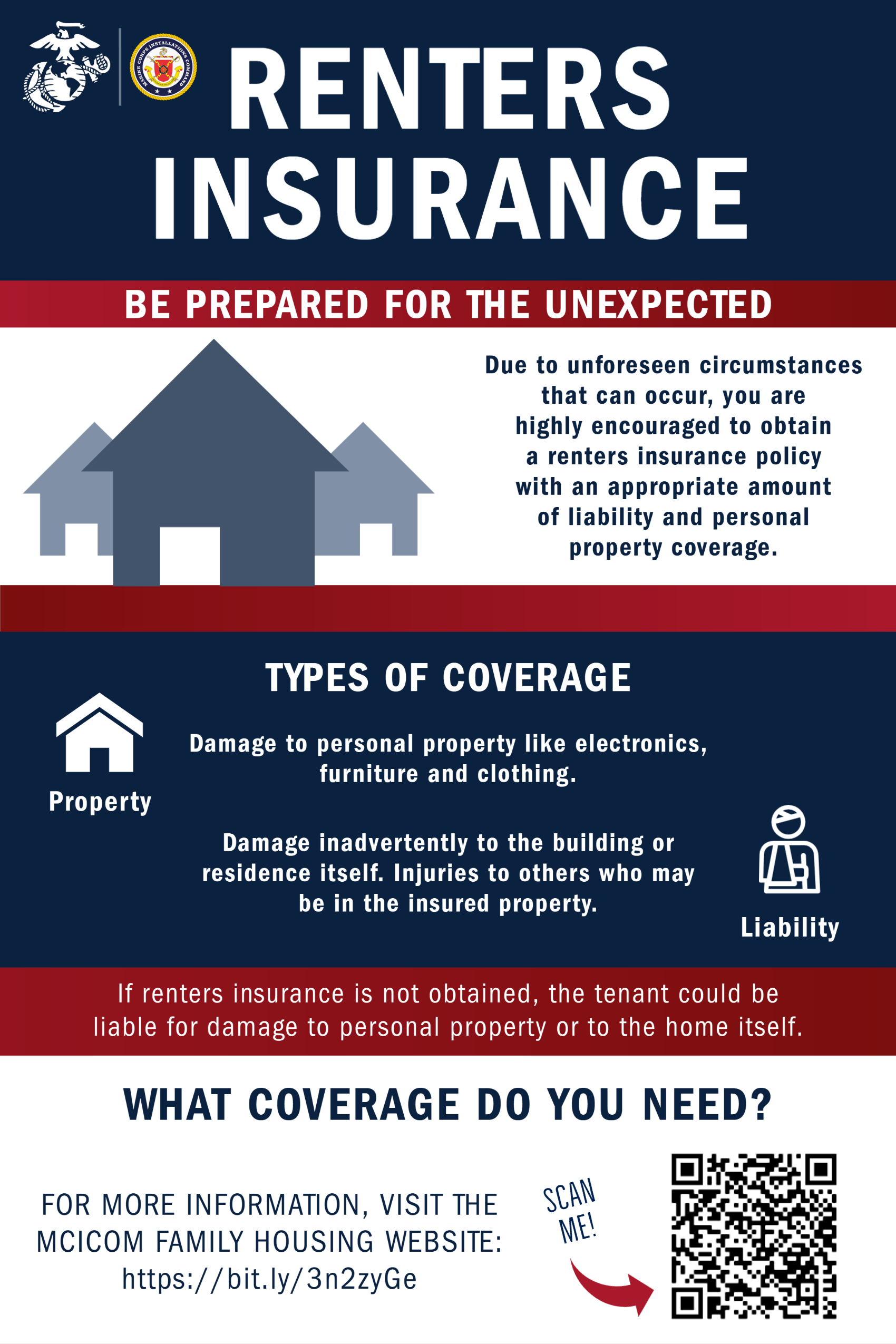

Renter's insurance is a critical safeguard for anyone living in a rental property. It provides financial protection for your personal belongings in case of incidents such as theft, fire, or natural disasters. Unlike homeowner's insurance, which covers the property itself, renter's insurance focuses on the tenant's possessions and personal liability. Before you rent an apartment or house, it’s essential to understand the types of coverage available, what is typically included in a policy, and how it can help mitigate potential financial losses.

When considering renter's insurance, it's important to assess your needs and the value of your belongings. Most policies cover items like furniture, electronics, and clothing, but certain high-value items may require additional coverage. Additionally, renter's insurance often includes personal liability protection, which can cover legal fees and medical expenses if someone is injured in your rented space. To make an informed decision, compare different policies and premiums, and consider speaking with an insurance agent to tailor a plan that fits your lifestyle.

Is Renter's Insurance Worth It? The Hidden Costs of Not Having Coverage

For many renters, the question arises: Is renter's insurance worth it? The answer often lies in understanding the potential hidden costs of not having coverage. Renter's insurance can provide financial protection against unexpected events like theft, fire, or water damage. Without this coverage, you could be left to cover the full costs of replacing your belongings out-of-pocket, which can add up quickly. For instance, if a fire damages your apartment and you lose thousands in personal belongings, the financial burden can be overwhelming, highlighting the importance of having adequate coverage.

Consider the potential hidden costs when assessing the value of renter's insurance. Beyond the immediate financial implications, there are emotional and stress-related burdens to consider. Having the peace of mind that comes with knowing your possessions are protected allows you to enjoy your living space without constant worry. Additionally, many landlords now require tenants to maintain renter's insurance as part of the lease agreement, further emphasizing the necessity of this coverage. Overall, the benefits of renter's insurance often far outweigh the costs, making it a smart investment for any renter.