Pulse of Information

Stay updated with the latest news and insights.

Is Your Small Business a Sitting Duck Without Insurance?

Protect your small business from unforeseen risks—discover why insurance is essential and avoid becoming a sitting duck!

The Risks of Operating a Small Business Without Insurance

Operating a small business without insurance exposes owners to significant financial risks that can jeopardize their entire venture. Without the protection of an insurance policy, a business owner could be held personally liable for accidents, injuries, or damages that occur on their premises or as a result of their products. This means that a single lawsuit could lead to overwhelming legal fees and settlements, potentially wiping out personal savings and investments. Furthermore, in industries prone to accidents, such as construction or manufacturing, the absence of insurance can be particularly devastating, as the cost of unforeseen events can escalate rapidly.

In addition to financial implications, the lack of insurance can have negative effects on a business's reputation and operational continuity. Clients and customers may perceive an uninsured business as untrustworthy or unprofessional, leading to lost opportunities and diminished sales. Additionally, without coverage, business owners may struggle to secure contracts or partnerships, as many clients require proof of insurance before engaging in business. In this environment, a small business without the appropriate protections may find itself not only facing greater risks but also hindering its growth potential in a competitive market.

Top 5 Reasons Your Small Business Needs Insurance Today

Insurance is essential for small businesses to safeguard against unforeseen risks. Here are the top 5 reasons why your small business needs insurance today:

- Financial Protection: Insurance helps protect your assets, providing financial security in the event of property damage, liability claims, or lawsuits.

- Legal Compliance: Many jurisdictions require businesses to have certain types of insurance, such as workers' compensation, to operate legally.

- Customer Confidence: Having insurance can enhance your reputation, giving customers peace of mind knowing they are dealing with a responsible and trustworthy business.

- Business Continuity: Insurance can facilitate a quicker recovery from unexpected events, ensuring that you can continue your operations with minimal interruption.

- Peace of Mind: With the right insurance, you can focus on growing your business instead of worrying about potential risks and liabilities.

Is Your Business Prepared for a Crisis? Understanding the Importance of Insurance

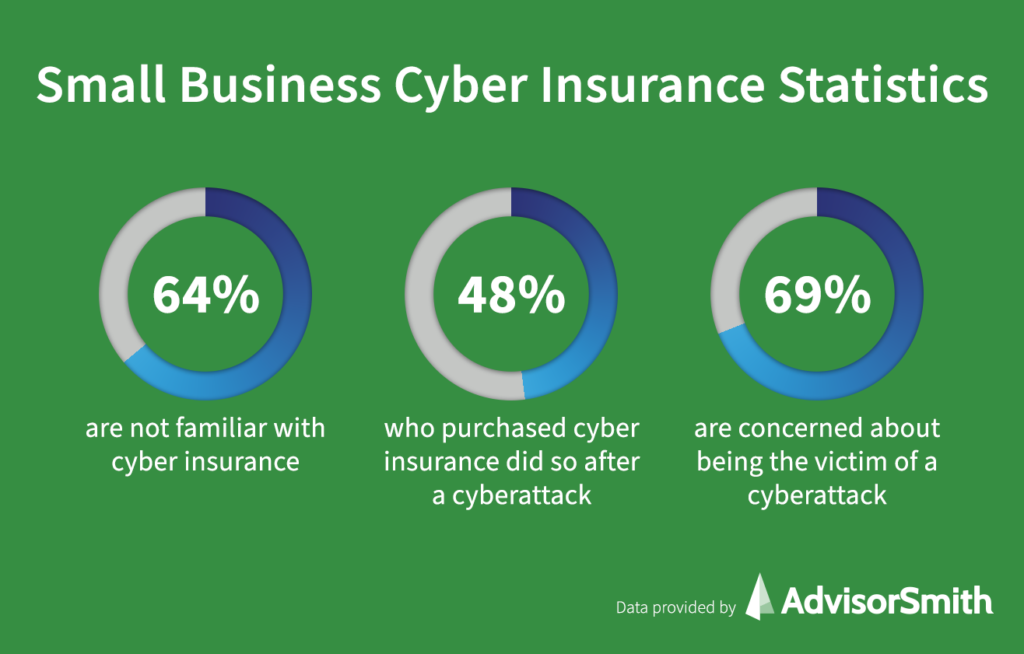

In today's unpredictable business landscape, crisis preparedness is no longer a luxury; it's a necessity. Insurance plays a crucial role in safeguarding your business against unforeseen events, from natural disasters to cyberattacks. Without proper coverage, a single crisis could lead to significant financial losses or even business closure. By investing in comprehensive insurance policies, you proactively protect your assets, employees, and reputation, ensuring that your business can weather any storm that comes its way.

Furthermore, having the right insurance not only provides financial security but also establishes trust with your stakeholders. Clients and partners are more likely to engage with a business that demonstrates responsibility and foresight in crisis management. So ask yourself: Is your business prepared for a crisis? Consider assessing your current insurance policies, identifying any gaps, and consulting with industry experts to develop a robust crisis management plan. Remember, a well-prepared business is a resilient business.