Pulse of Information

Your source for the latest insights and updates.

The Secret Life of Auto Insurance Discounts Revealed

Unlock hidden savings on auto insurance! Discover the secrets to maxing out your discounts and keeping more money in your pocket.

Unlocking Hidden Savings: A Guide to Auto Insurance Discounts

Auto insurance can often seem like a hefty expense, but many drivers are unaware of the numerous auto insurance discounts that can significantly lower their premiums. From safe driving to bundling policies, understanding the various types of discounts available is crucial. Here are some common discounts to consider:

- Good Driver Discount: Drivers with a clean driving record may qualify for this discount.

- Multi-Policy Discount: Bundling auto insurance with home or renter's insurance can lead to substantial savings.

- Student Discount: Many insurers offer discounts for young drivers who maintain good grades.

In addition to standard discounts, some insurers offer loyalty discounts for long-term customers, or low mileage discounts for those who drive less frequently. Exploring these options can lead to significant savings, ultimately making insurance coverage more affordable. Remember to regularly review your auto insurance policy and discuss available discounts with your insurer, as they may change over time and you could be missing out on valuable savings.

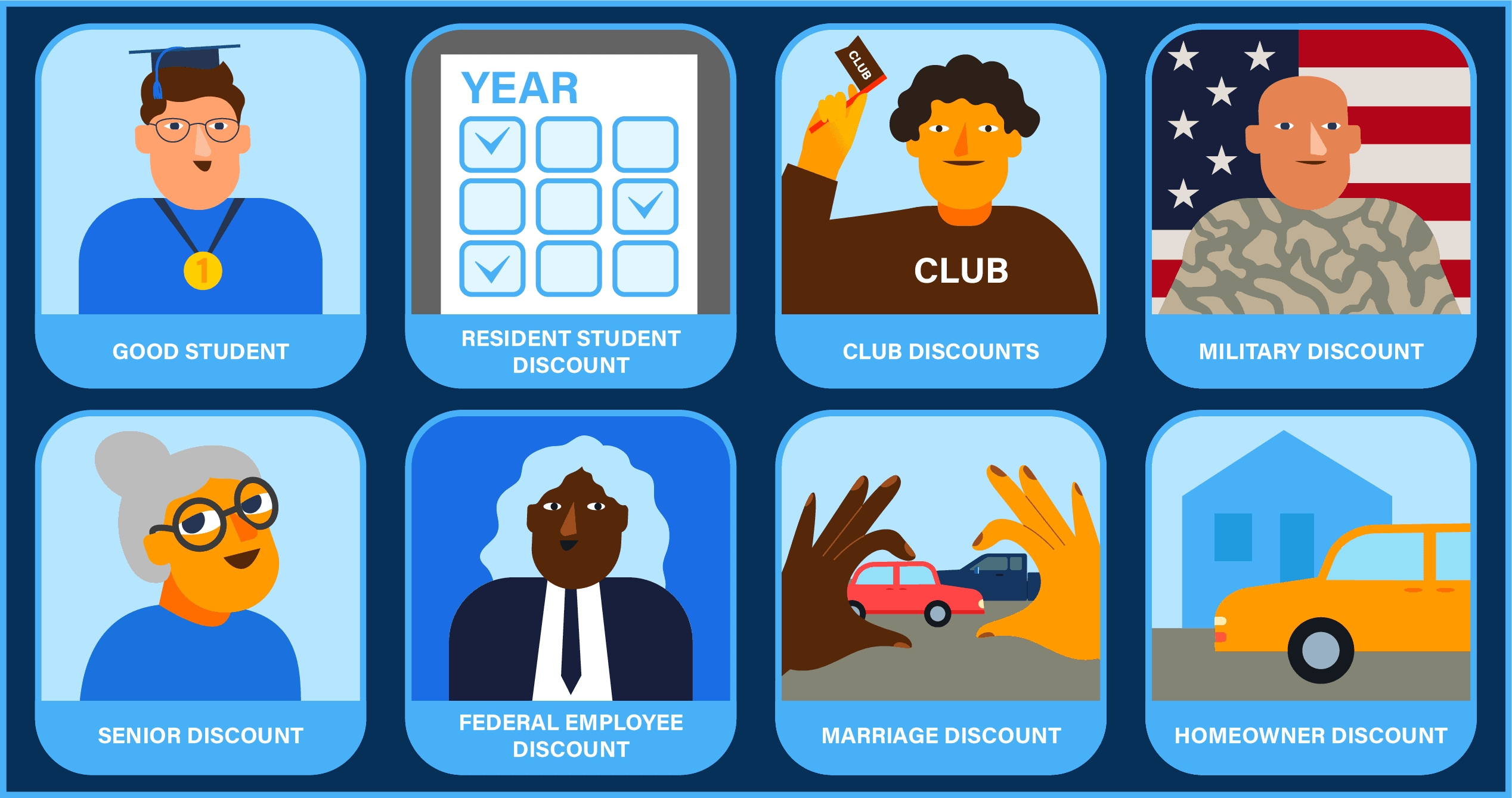

Top 10 Auto Insurance Discounts You Might Be Missing Out On

When it comes to saving on your auto insurance, many drivers are unaware of the discounts they may qualify for. Here are the Top 10 Auto Insurance Discounts you might be missing out on:

- Multi-Policy Discount: Bundling your auto insurance with home or other policies can save you a significant amount on your premiums.

- Safe Driver Discount: Maintaining a clean driving record with no accidents or traffic violations can earn you lower rates.

- Good Student Discount: If you’re a student with good grades, many insurers offer discounts as a reward for your academic achievements.

- Low Mileage Discount: Driving less than a certain number of miles per year can qualify you for a discount, as it reduces your risk of accidents.

- Military Discount: Active military members and veterans often receive special rates or discounts on auto insurance.

- Vehicle Safety Features Discount: Cars equipped with safety features like anti-lock brakes, airbags, and anti-theft systems may qualify for additional discounts.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can reduce your premium as it indicates you are a safer driver.

- Continuous Coverage Discount: Staying insured without any gaps in coverage can also lead to lower insurance costs.

- Membership Discounts: Affiliations with certain organizations or clubs can sometimes come with exclusive discounts on auto insurance.

- Senior Discount: Older drivers might qualify for discounts based on age-related criteria, reflecting their experience on the road.

Do You Qualify? Discover the Secrets Behind Auto Insurance Discounts

Are you feeling overwhelmed by auto insurance premiums? You might be surprised to discover that many drivers qualify for a variety of auto insurance discounts that can significantly lower their payments. Discounts can vary by provider, but common types include safe driver discounts, multi-policy discounts, and good student discounts. Understanding what options are available to you is essential in maximizing your savings. Each insurer has its own criteria, so it’s important to ask your agent about specific qualifications and how to take advantage of these potential savings.

To get you started on your journey towards unlocking these benefits, here are a few tips to consider:

- Maintain a clean driving record: Safe drivers often enjoy lower rates.

- Bundle your policies: Combining auto with home or renters insurance can lead to significant savings.

- Take advantage of discounts for vehicle safety features: Cars equipped with advanced safety technologies may qualify for discounts.