Pulse of Information

Your source for the latest insights and updates.

Uncovering the Secret World of Auto Insurance Discounts

Unlock hidden auto insurance discounts! Discover tips and tricks to save big on your policy today. Don't miss out on potential savings!

Unlocking Savings: Essential Auto Insurance Discounts You Might Be Missing

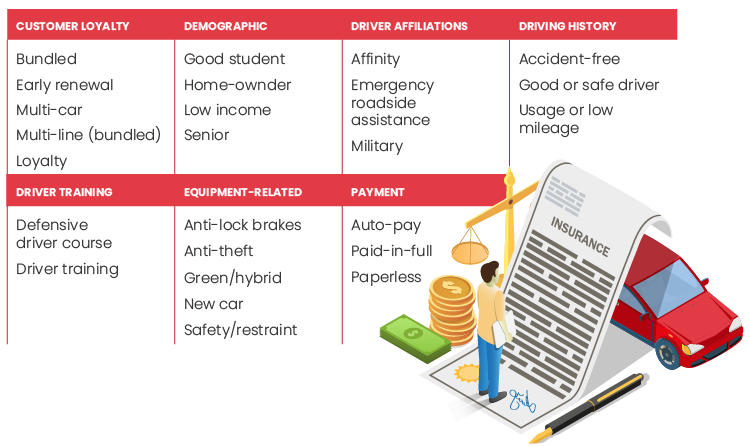

Finding ways to save on auto insurance can often feel overwhelming, but many drivers are unaware of the essential auto insurance discounts that could significantly lower their premiums. One common discount is the multi-policy discount, which rewards you for bundling your auto insurance with other policies, such as home or renters insurance. Additionally, many insurers offer discounts for vehicles equipped with safety features, which reduce the risk of accidents. Always ask your insurance agent about available discounts; you might be surprised by what you qualify for!

Another great way to unlock savings is through good driver discounts. If you maintain a clean driving record free of accidents and violations, your insurer may reward you with lower rates. Furthermore, many companies provide discounts for low annual mileage, as fewer miles driven typically translates to a lower risk of accidents. Don’t forget to check for discounts related to your membership in certain organizations, military service, or even student discounts if you're a young driver. By taking advantage of these opportunities, you can ensure you are not missing out on potential savings.

The Ultimate Guide to Finding Auto Insurance Discounts: Are You Qualifying?

Finding auto insurance discounts can significantly reduce your premiums, making your policy more affordable. Many insurance companies offer various types of discounts to attract and retain customers. Common discounts include those for safe driving records, multiple policies, or bundling home and auto insurance. Additionally, discounts may be available for certain demographics, such as students or seniors, and even for vehicles equipped with safety features. To ensure you're not missing out on any savings, take the time to ask your insurance provider about all available options.

Another effective strategy for maximizing your auto insurance discounts is to regularly review your policy. As your circumstances change, such as moving to a safer neighborhood or upgrading your vehicle, you might qualify for additional savings. Furthermore, some insurers provide discounts for participating in defensive driving courses or for low mileage drivers. Be proactive; compare quotes from different companies at least once a year to ensure you're getting the best rates possible. By being diligent and informed, you can significantly cut your costs and ensure you're fully covered.

Do You Qualify? Discover Hidden Auto Insurance Discounts That Can Lower Your Premium

If you're looking to lower your premium, you may be surprised to learn that there are several hidden auto insurance discounts you might qualify for. Discounts vary by insurer, but many companies offer reductions for safe driving records, multiple policies, and even for completing defensive driving courses. Additionally, young drivers can often benefit from discounts for good grades, while seniors may find savings simply for being less frequently on the road.

To ensure you don’t miss out, it's essential to discover hidden auto insurance discounts specific to your situation. When consulting with your insurance agent, be sure to ask about:

- Membership discounts (AAA, military, etc.)

- Low mileage discounts

- Automatic payment and paperless billing discounts

- Vehicle safety features discounts