Pulse of Information

Stay updated with the latest news and insights.

Unlocking Hidden Savings in Your Auto Insurance Bill

Discover untapped savings on your auto insurance! Uncover tips and tricks to lower your bill and keep your hard-earned cash.

5 Common Auto Insurance Discounts You Might Be Missing

When it comes to auto insurance, many drivers may not realize they could be saving money through discounts. Here are 5 common auto insurance discounts you might be missing. First, consider being a safe driver. Many insurance companies offer discounts for those who maintain a clean driving record, free from accidents and violations. Next, if you're a student, check for good student discounts. Insurers often reward students with good grades, showcasing responsibility behind the wheel.

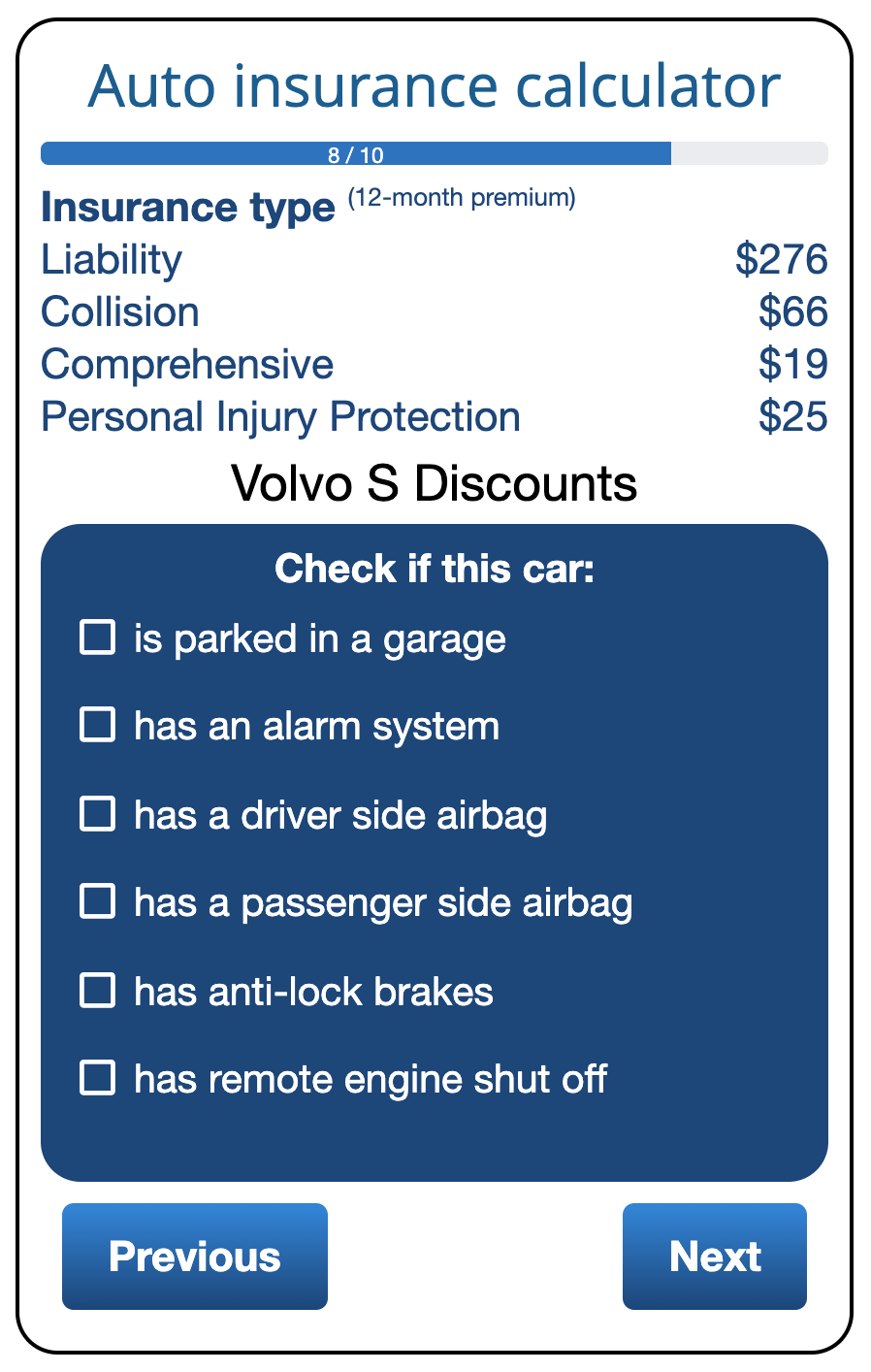

Additionally, consider bundling your policies. If you have home, renters, or life insurance, combining these with your auto policy can lead to significant savings through a multi-policy discount. Another aspect to explore is your vehicle's safety features. Cars equipped with advanced safety technology may qualify for safety discounts. Lastly, don’t overlook low mileage discounts. If you drive fewer miles than average, you could be eligible for a lower premium, reflecting a reduced risk for the insurer.

How to Review Your Auto Insurance Policy for Hidden Savings

Reviewing your auto insurance policy regularly is essential for uncovering hidden savings that could significantly reduce your premiums. Start by gathering your current policy documents and reviewing the coverage limits. Look for any unnecessary add-ons or out-of-date coverages that may not apply to your current situation. For example, if your vehicle's value has decreased, you might want to adjust your collision and comprehensive coverage accordingly. Additionally, consider comparing quotes from other companies to ensure you're getting the best deal possible.

Another effective method to identify hidden savings is to inquire about discounts. Many insurers offer a variety of discounts that policyholders may overlook. These can include safe driver discounts, multi-policy discounts, or even low-mileage discounts if you don't drive frequently. Contact your insurance agent to ask about potential savings opportunities and ensure you're maximizing all available discounts. Lastly, consider raising your deductible if it fits your financial situation; this can lower your monthly payments while still providing essential coverage.

Are You Paying Too Much? Tips to Find Unseen Savings in Your Auto Insurance

When it comes to auto insurance, many drivers unknowingly pay more than necessary for their coverage. To ensure you’re not among them, start by reviewing your current policy. Check for any outdated or unnecessary features that may inflate your premium. Additionally, consider the importance of shopping around; by comparing quotes from various insurers, you could discover better deals that offer the same level of protection for less. Don’t forget to utilize online comparison tools to streamline this process.

Another effective strategy to uncover unseen savings is to review available discounts. Insurance companies often provide various discounts for safe driving records, bundling policies, or even for completing defensive driving courses. Speak to your agent and ask about these opportunities; you might be surprised at how many savings options are available to you. Lastly, consider raising your deductible. While this means you’ll pay more out-of-pocket in the event of a claim, it can significantly lower your monthly premium, leading to substantial overall savings.