Pulse of Information

Stay updated with the latest news and insights.

Whole Life Insurance: The Secret Sauce for Financial Freedom

Unlock financial freedom! Discover how whole life insurance can be your secret weapon for building wealth and securing your future.

Understanding Whole Life Insurance: A Pathway to Financial Security

Whole life insurance is a type of permanent life insurance that provides both a death benefit and a cash value component, making it a unique financial product for those seeking long-term security. Unlike term insurance, which offers coverage for a specific period, whole life insurance lasts your entire lifetime as long as premiums are paid. The steady premiums ensure that you are safeguarded against the risks of rising costs in the future, providing the peace of mind that comes with knowing your loved ones are financially protected. This dual nature allows policyholders to not only prepare for the unexpected but also to accumulate savings over time, creating a solid foundation for financial security.

Moreover, the cash value growth in whole life insurance is tax-deferred, offering an attractive incentive for individuals looking to enhance their long-term financial planning. As a policyholder, you can borrow against the accrued cash value, providing a source of funds for emergencies or significant life events. However, it's essential to understand the potential implications of borrowing, such as reduced death benefits. By comprehensively understanding the mechanics of whole life insurance, individuals can weave it into their overall financial framework as a strategy to achieve greater financial security and peace of mind for the future.

Is Whole Life Insurance the Key to Long-Term Wealth? Finding the Answers

The question, Is Whole Life Insurance the Key to Long-Term Wealth?, has been a topic of discussion for many financial planners and individuals alike. Whole life insurance is more than a safety net; it serves as an investment vehicle that provides both a death benefit and a cash value that grows over time. Unlike term insurance, which only pays out upon death, whole life policies build a cash value that policyholders can borrow against or withdraw during their lifetime. This dual-purpose nature of whole life insurance makes it a compelling option for those looking to secure their financial future while also building long-term wealth.

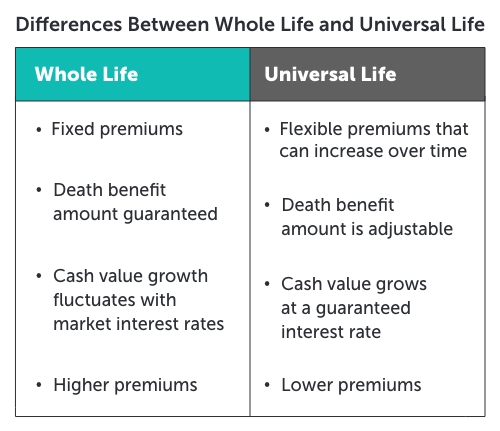

However, it is essential to evaluate whole life insurance against other investment options. While it offers guaranteed returns and a death benefit, the cost of premiums can be significantly higher than term life policies, which may deter some potential buyers. Additionally, the growth of the cash value is generally slower compared to stocks or mutual funds. Therefore, understanding your financial goals, risk tolerance, and long-term plans is crucial. Consulting with a financial advisor can help you make an informed decision, ultimately providing clarity on whether whole life insurance is indeed the key to achieving your long-term wealth objectives.

The Benefits of Whole Life Insurance: Why It Matters for Your Financial Freedom

Whole life insurance is more than just a safety net; it's a strategic investment in your financial future. One of its most notable benefits is the guaranteed cash value accumulation. Unlike term insurance, whole life policies build cash value over time, which can be borrowed against or withdrawn if needed. This cash value can serve as a source of funds for emergencies, education expenses, or other financial goals, ultimately empowering you to take control of your finances and achieve greater financial freedom.

Another compelling reason to consider whole life insurance is its role in lifetime coverage. As long as premiums are paid, the policy remains in effect for your entire life, providing peace of mind knowing your loved ones will not face financial burdens in the event of your passing. This benefit can be particularly valuable for estate planning, ensuring that your family is well-supported and any debts or obligations are met. By choosing whole life insurance, you are making a commitment to your family's future, which is a vital aspect of attaining financial freedom.